Property Tax On Leased Car In Texas

Our texas lease customer must pay full sales tax of $1875 added to the $30,000 cost of his vehicle. The standard tax rate is 6.25 percent.

2

Texas is the only state that still taxes the capitalized cost of a leased vehicle.

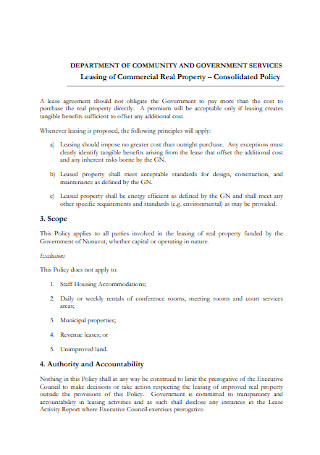

Property tax on leased car in texas. The vehicle may be registered in the lessor’s name and still qualify for the new resident tax as long as the new resident is named as the lessee under the lease agreement. Tax code section 11.252 defines these vehicles as passenger cars or trucks with a shipping weight of. In order to do so, the leasing company must have the correct garaging address of the vehicle.

Since leased vehicles produce income for the leasing company and are taxable to the leasing company. As the property owners, we will set up, process, and post all property tax accounts and bills—so your business accountant won’t be doing this; In texas, all property is taxable, unless exempt by state or federal law.

The lease contract is not subject to tax. Seems that oklahoma had always taxed leased items as property and texas wanted in on the game. The property tax is assessed to the leasing company based on the lessee’s residence as of january 1 of each year.

A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. Per a survey completed by the texas comptroller in 2005, 75 cities chose to continue taxing all leased vehicles, both. In other states, generally only the monthly lease payments are taxed, similar to the new law in illinois.

However, if you rent out the leased equipment without operating it yourself, a sales and use tax applies. Property taxes on the vehicle are not applicable for the lessee. All leased vehicles for lessees residing in the city of carrollton are taxable.

Let check our website regularly to know more about leased vehicle property tax texas. Only the service is charged tax. Except, in arkansas, illinois, maryland, oklahoma, texas and virginia , where you pay sales tax on the entire value of the car.

When a vehicle is leased in another state and the lessee brings it to texas for public highway use, the lessee (as the operator) owes motor vehicle use tax based on the price the lessor paid for the vehicle. Leased vehicles for personal use. Motor vehicle tax is due from the lessee at the time of titling and registration on the purchase of the motor vehicle from the lessor, since a new taxable sale (second transaction) has occurred, whether the vehicle was leased in texas or out of state.

Although who pays property tax on leased equipment is clear, it’s important to many business owners for their accountant to be aware of and on the same page about all things financial. You see, if you own a car, you pay taxes on the full value of the car, albeit once. The tax bills are sent to the leasing companies in the following

Things get a bit more complicated though, because in texas, your city may also charge property tax on the leased vehicle, even if it's for personal use. When a vehicle is leased in another state and the lessee brings it to texas for public highway use, the lessee (as the operator) owes motor vehicle use tax based on the price the lessor paid for the vehicle. If a new texas resident brings a leased motor vehicle into texas, the new resident owes the $90 new resident tax.

A city, however, may continue to tax personal leased vehicles, if the city adopted an ordinance to do so before january 1, 2002. In texas, all property is considered taxable, unless it is exempt by state or federal law. Does that mean you have to pay property tax on a leased vehicle?

All leased vehicles with a garaging address in texas are subject to property taxes. 76 cities adopted such ordinance before the tax code changed in 2002. No credit is allowed against the new resident tax for tax paid to another state.

Tax assessors bill the car dealer for vehicle taxes, but whether or not they pass that on to you will be delineated in your lease contract. If you do pay the personal property tax, you can deduct it on your taxes if. When you lease a vehicle, the car dealer maintains ownership.

Motor vehicles leased for personal use after january 2, 2001 may be exempt from property taxes. All personal use vehicles are exempt from county and school taxes. Lets say you leased a bmw 320i sales price is 33,000, and your lease over 27 months totals $10,000 dollars, then you'd be responsible for sales tax of 6.25% on $10,000, or 625.00.

If you didn’t already know, the following states apply a “personal property tax” on all leased vehicles: There are some available advantages to leasing a vehicle in a business name (please consult your tax. The leasing company will be billed for personal property tax directly.

In another state, for the same vehicle, same price, and same tax. In many leasing contracts, companies require their lessees to reimburse them for taxes assessed on the. The city of carrollton did pass such an ordinance to continue to tax personal leased vehicles.

If having any change, any new information for leased vehicle property tax texas , we will post on our site as soon as possible. Motor vehicles leased for use other than production of income please read property tax code section 11.252 for all details on this legislation. The standard tax rate is 6.25 percent.

Arkansas, connecticut, kentucky, massachusetts, missouri, north carolina, rhode island, texas (haha i always found it funny how when you flip the a and the e in texas, you get taxes, lol), virginia, west virginia and orleans parish (louisiana). Leased vehicles produce income for the leasing company and are in turn, taxable to the leasing company. We track the leased vehicle property tax texas rental market every day.

Richardson City Officials Considering Change In Taxation For Some Leased Vehicles Community Impact

Lease A New Toyota From Mike Shaw Toyota In Corpus Christi Tx

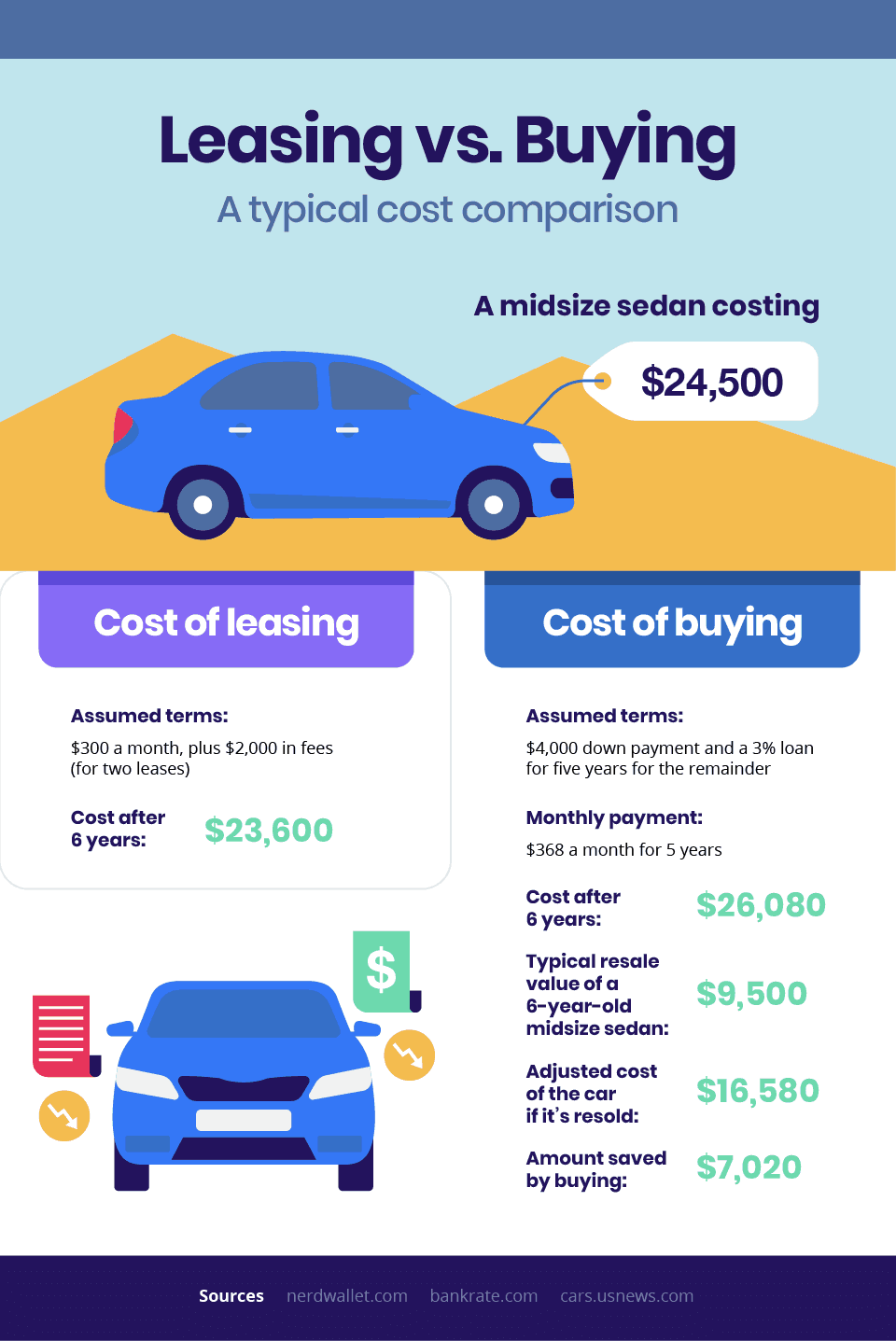

Is It Better To Buy Or Lease A Car Taxact Blog

Nl Termination Notice For Damage To Premises Ez Landlord Forms Being A Landlord Lettering Real Estate Forms

Lease Services

Leased Departments Examples

What Is A Crime Of Extortion Criminal Law Lawyer Extortion Crime Criminal

Monthly Rental Agreement Real Estate Forms Rental Agreement Templates Being A Landlord Real Estate Forms

Leased Departments Examples

2

Leased Departments Examples

Property Description Oude Molen Park Is A Modern Industrial Park Situated In A Leafy Quiet Area 5 Minutes From Quiet Area Industrial Park Modern Industrial

Recreational Vehicles And Californias Lemon Law Minds Recreational Vehicles Lemon Law Rockwall

Simple Room Rental Agreement Real Estate Forms Rental Agreement Templates Room Rental Agreement Being A Landlord

Is It Better To Buy Or Lease A Car Taxact Blog

Which Us States Charge Property Taxes For Cars - Mansion Global

Leased Departments Examples

Lemon Law In Wisconsin Lemon Law Wisconsin Understanding

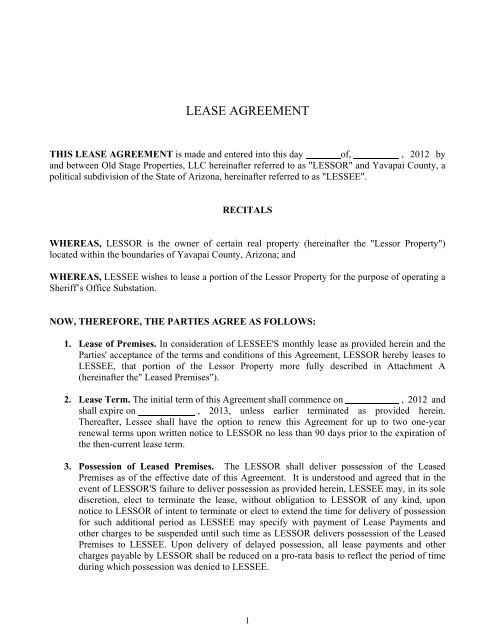

Lease Agreement