How Are Property Taxes Calculated In Pasco County Florida

Eligibility for property tax exemptions depends on certain requirements. Please note that we can only estimate your property tax based on median property taxes in your area.

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Send us a message or give us a call today!

How are property taxes calculated in pasco county florida. The florida property tax statute and the florida state consitution are the main legal documents regarding taxation in the state of florida. This brochure contains frequently asked questions about exemptions, and i trust you will find it informative. Commercial usage of property is not subject to this.

The median property tax on a $157,400.00 house is $1,369.38 in pasco county. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. How to accurately calculate the holding costs for your house in pasco county;

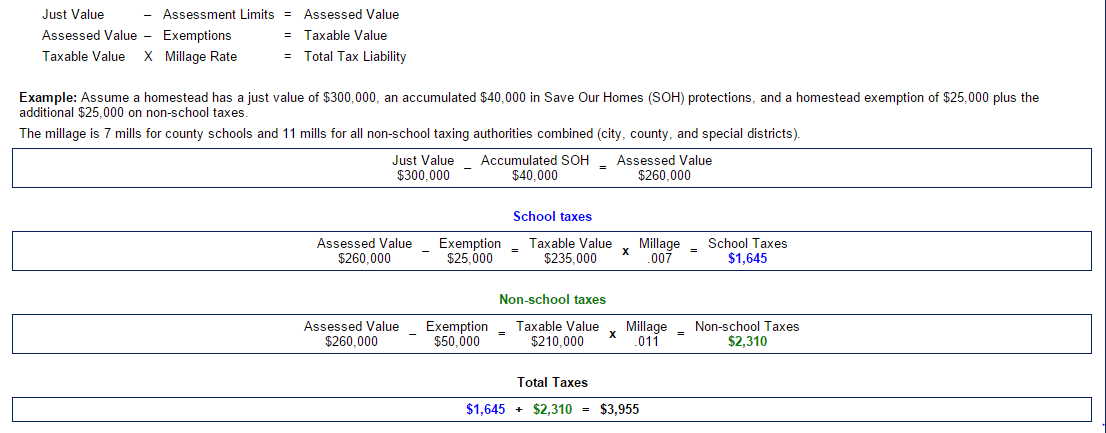

If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the pasco county tax appraiser's office. Do you have delinquent property taxes on your pasco county house? The tax amount is calculated by multiplying the taxable value by the millage rate and.

Property taxes (no mortgage) $80,922,900: Interest on the tax certificate accrues at a minimum of 5% and maximum of 18%. 2 hours ago see detailed property tax report for 13920 3 st, pasco county, fl.

How to sell a house in pasco county with fire or water damage; The condition and status of your property on this date will determine the just value, assessed value, and taxable value for the year. The top 5 questions we receive about selling a house in pasco county;

Pasco county calculates the property tax due based on the fair market value of the home or property in question, as determined by the pasco county property tax assessor. We have worked with people all over the pasco county area who were dealing with property tax problems. Pasco county property records are real estate documents that contain information related to real property in pasco county, florida.

Pasco county, florida property taxes are normally calculated as a percentage of the value of the taxable property. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a. A board of county commissioners or the.

Base tax is calculated by multiplying the property's assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Certain property tax benefits are available to persons 65 or older in florida. The median property tax on a $157,400.00 house is $1,526.78 in florida.

Calculate taxes to calculate your taxes, we first need to locate your property. The above property tax bill is meant to serve as a general example showing the different agencies that levy taxes for. If you're 100% permanent and total, you may be entitled to a full exemption.

Pasco county provides taxpayers with a variety of tax exemptions that may lower property's tax bill. Rates vary widely across the country, normally ranging from less than 1% at the low end, to about 5% at the high end. Pasco county property tax collections (total) pasco county florida;

Taxes are determined at local levels, being used for schools, fire and police protection, and other public services and benefits. After two years the property may be sold at public auction if. Let us help you by using our knowledge and expertise to get you out of the situation fast!

Information is available from the property appraiser’s office in the county where the applicant owns a homestead or other property. Mike wells pasco county property appraiser pasco county, florida. These are deducted from the assessed value to give the property's taxable value.

5 tax tips for property sellers in pasco county; To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please visit our search page , locate your property, then click on the 'estimate taxes' link at the top.

Mike wells pasco county property appraiser. We are here to help you with solutions!

Florida Property Tax Calculator - Smartasset

Florida Property Tax Calculator - Smartasset

Pasco-county Property Tax Records - Pasco-county Property Taxes Fl

Pasco-county Property Tax Records - Pasco-county Property Taxes Fl

With Pasco Property Values Up More Than 10 Percent Commission Maintains Tax Rates

Pasco-county Property Tax Records - Pasco-county Property Taxes Fl

Pascocountyflnet

Pasco County Property Appraiser How To Check Your Propertys Value

Property Tax By County Property Tax Calculator Rethority

Pasco County Holds The Line On Tax Rates For Next Year

Calculate Taxes Pasco County Property Appraiser

Pasco-county Property Tax Records - Pasco-county Property Taxes Fl

Florida Property Tax Calculator - Smartasset

Calculate Taxes Pasco County Property Appraiser

With Pasco Property Values Up More Than 10 Percent Commission Maintains Tax Rates

Property Tax Rates Drop Or Hold Steady In Pasco Cities

Property Taxes In Tampa Florida

Property Tax By County Property Tax Calculator Rethority

Florida Property Tax Hr Block