Sales Tax Calculator Reno Nv

There is no city sale tax for reno. And 10% retail excise tax on the sale price when sold by.

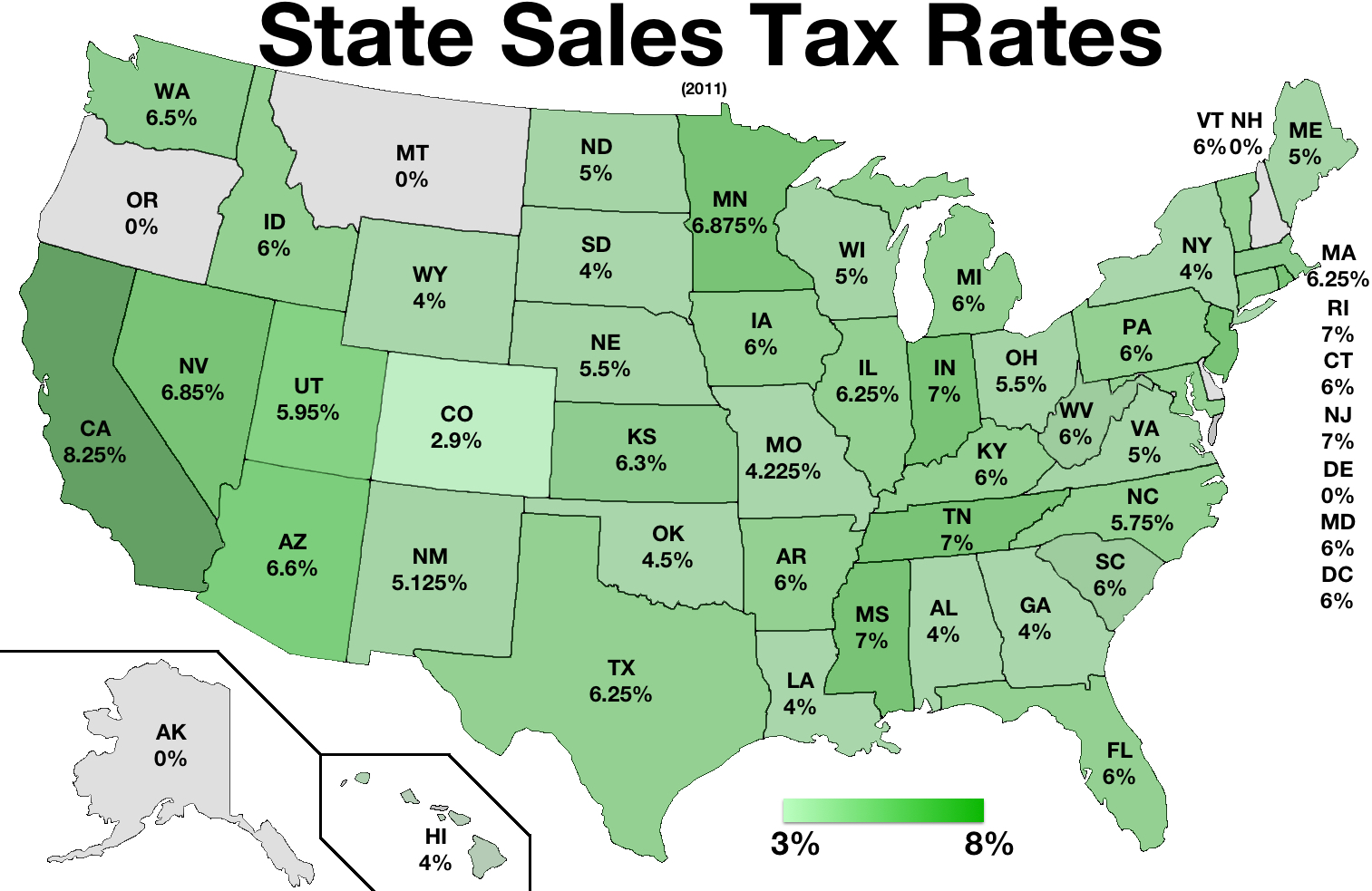

Sales Taxes In The United States - Wikiwand

The reno sales tax rate is %.

Sales tax calculator reno nv. Nevada cities and/or municipalities don't have a city sales tax. Ad a tax advisor will answer you now! The reno, nevada, general sales tax rate is 4.6%.

The state general sales tax rate of nevada is 4.6%. Sales & use tax return (7/1/11 to current) this is the standard monthly or quarterly sales and use tax return used by retailers. The las vegas, nevada, general sales tax rate is 4.6%.

The reno, nevada, general sales tax rate is 4.6%. Every 2021 combined rates mentioned above are the results of nevada state rate (4.6%), the county rate (3.65% to 3.775%). The current total local sales tax rate in sparks, nv is 8.265%.

Our premium cost of living calculator includes, state and local income taxes, state and local sales taxes, real estate transfer fees, federal, state, and local consumer taxes (gasoline, liquor, beer, cigarettes), corporate taxes, plus auto sales, property and registration taxes, and an online tool to customize your own personal estimated tax burden. The current total local sales tax rate in reno, nv is 8.265%. Low property taxes and the absence of any state or local income taxes in nevada can make it a particularly affordable place to own a home.

This is the total of state, county and city sales tax rates. The december 2020 total local sales tax rate was also 8.265%. Effective january 1, 2020 the clark county sales and use tax rate increased to 8.375%.

Sales tax still applies in addition to those excise tax rates. The nevada sales tax rate is currently %. Every 2021 combined rates mentioned above are the results of nevada state rate (4.6%), the county rate (2.25% to 3.775%), and in some case, special rate (0% to 0.25%).

Nevada largely earns money from its sales tax, which can be one of the highest in the nation and varies from 6.85% to 8.375%. , nv sales tax rate. Some dealerships may also charge a 149 dollar documentary fee.

How 2021 sales taxes are calculated in las vegas. The county sales tax rate is %. Ad a tax advisor will answer you now!

What are the taxes on cannabis? This is an increase of 1/8 of 1 percent on the sale of all tangible personal property that is taxable. Depending on the zipcode, the sales tax rate of reno may vary from 4.6% to 8.265%.

Questions answered every 9 seconds. In addition to taxes, car purchases in nevada may be subject to other fees like registration, title, and plate fees. You may also be interested in printing a nevada sales tax table for easy calculation of sales taxes when you can't access this calculator.

101 rows the 89502, reno, nevada, general sales tax rate is 8.265%. 15% excise tax on the first wholesale sale (calculated on the fair market value); Questions answered every 9 seconds.

The total overlapping tax rate (subject to approval by the nevada tax commission) for the city of reno is $3.660615 per $100 of assessed valuation. The minimum combined 2021 sales tax rate for reno, nevada is. Whether you’re driving through nevada or living there permanently, you’ll need to pay the state’s gas tax.

Depending on the zipcode, the sales tax rate of reno may vary from 4.6% to 8.265% depending on the zipcode, the sales tax rate of reno may vary from 4.6% to 8.265% How 2019 q2 sales taxes are calculated in reno. You can use our nevada sales tax calculator to determine the applicable sales tax for any location in nevada by entering the zip code in which the purchase takes place.

From 14.1% to 22% abv, the rate is $1.30 per gallon, and from 22.1% to 80% abv, which includes most liquors, the rate is $3.60 per gallon. Every 2019 q2 combined rates mentioned above are the results of nevada state rate (4.6%), the county rate (3.665%). There is no applicable city tax or special tax.

Homeowner, no child care, taxes not considered: Starting july 1, 2017, cannabis will be taxed in the following way: How 2021 sales taxes are calculated in nevada.

The 8.265% sales tax rate in reno consists of 4.6% nevada state sales tax and 3.665% washoe county sales tax. City of reno property tax. Therefore, a home which has a replacement value of $100,000 will have an assessed value of $35,000 ($100,000 x 35%) and the home owner will pay approximately $1,281 in.

Depending on local municipalities, the total tax rate can be as high as 8.265%. You can find these fees further down on. Nevada collects a 8.1% state sales tax rate on the purchase of all vehicles.

Depending on the zipcode, the sales tax rate of las vegas may vary from 8.25% to 8.375%. The december 2020 total local sales tax rate was also 8.265%. The nevada (nv) state sales tax rate is currently 4.6%.

The Nevada Income Tax Rate Is 0 - This Does Not Mean You Will Not Be Taxed On Your Earnings

Nevada Sales Tax - Small Business Guide Truic

Doordash Tax Calculator 2021 What Will I Owe How Bad Will It Hurt

Nevada Sales Tax Calculator

Total Sales Tax Rate Nevada Turbotax English As A Second Language At Rice University

Sales Tax Rates Nevada By County English As A Second Language At Rice University

Ebay Integration Taxjar

Nevada Sales Tax - Taxjar

Nevada State Reno Sales Tax English As A Second Language At Rice University

How To Calculate Sales Tax Definition Formula Example

Sales Taxes In The United States - Wikiwand

Sales Taxes In The United States - Wikiwand

Sales Tax Rates Nevada By County English As A Second Language At Rice University

Is Shipping In Nevada Taxable Taxjar Blog

Sales Tax Rates Nevada By County English As A Second Language At Rice University

Sales Tax Rates Nevada By County English As A Second Language At Rice University

Nevada Income Tax Calculator - Smartasset

Nevada State Reno Sales Tax English As A Second Language At Rice University

Nevada Sales Tax Calculator 2018 English As A Second Language At Rice University