What Percent Is Taken Out Of Paycheck For Taxes In Massachusetts

Fica taxes are commonly called “the payroll” tax, however, they don’t include all taxes related to payroll. Both employee and employer shares in paying these taxes each paying 7.65%.

2

If you have a household with two jobs and both pay about the same click this button and exit.

What percent is taken out of paycheck for taxes in massachusetts. (look at the tax brackets above to see the breakout.) example #2: Massachusetts is a flat tax state that charges a tax rate of 5.00%. These are contributions that you make before any taxes are withheld from your paycheck.

Social security is 6.20% on all income up to 94,200 dollars and a maximum tax of $5,840.40. State residents who would like to contribute more to the state’s coffers also have the option to pay a higher income tax rate. For example, if your gross pay is $4,000 and your total tax payments are $1,250, then your percentage tax is 1,250 divided by 4,000, or 31.25 percent.

As seen on cnn, nbc, abc, and cbs. A total of 15.3% (12.4% for social security and 2.9% for medicare) is applied to an employee’s gross compensation. Unlike with the federal income tax, there are no tax brackets in massachusetts.

Your employer will withhold 6.2% of your wages in social security tax and 1.45% in medicare tax. If your household has only one job then just click exit. As seen on cnn, nbc, abc, and cbs.

If you had $50,000 of taxable income, you’d pay 10%. These amounts are paid by both employees and employers. The employer medical leave percentage.

Table border=0 cellspacing=1 cellpadding=2> your pay check results. The employer family leave percentage. Exit and check step 2 box otherwise fill out this form.

That rate applies equally to all taxable income. The income tax rate in massachusetts is 5.00%. $75000 annual salary paid bi weekly and you filled out your w4 form to claim single/0, then your paycheck would be calculated as follows:

Actually, you pay only 10% on the first $9,875; Check out our new page tax change to find out how federal or state tax changes affect your take home pay. Massachusetts state and local information.

This free, easy to use payroll calculator will calculate your take home pay. Now those are the direct taxes. No massachusetts cities charge their own local income tax.

So if you elect to save 10% of your income in your company’s 401(k) plan, 10% of your pay will come out of each paycheck. Fica taxes consist of social security and medicare taxes. Switch to massachusetts hourly calculator.

These make up fica (federal insurance contributions act) taxes. Note that you can claim a tax credit of up to 5.4% for paying your massachusetts state unemployment taxes in full and on time each quarter, which means that you’ll effectively be paying only 0.6% on your futa tax. Every pay period your employer will withhold 6.2% of your earnings for social security taxes and 1.45% of your earnings for medicare taxes.

Ad a tax advisor will answer you now! Calculates federal, fica, medicare and withholding taxes for all 50 states. Medicare taxes are a flat rateof 1.45% with no limit and no ceiling.

That goes for both earned income (wages, salary, commissions) and unearned income (interest and dividends). Social security taxes for 2017 are 6.2 percent on up to $127,200 in income, while medicare is 1.45 percent on all income. Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay.

Supports hourly & salary income and multiple pay frequencies. The medicare tax rate is 1.45%. Ad a tax advisor will answer you now!

You pay 12% on the rest. For 2021, employees will pay 6.2% in social security on the first $142,800 of wages. The tax rate is 6% of the first $7,000 of taxable income an employee earns annually.

You can add to the percentage of income tax you pay the amount of sociall security and medicaretaxes which is: Each pay period, you'll see money come out of your paycheck for social security and medicare taxes.

The Mystockoptions Blog Tax Planning

Massachusetts Paycheck Calculator - Smartasset

2

2

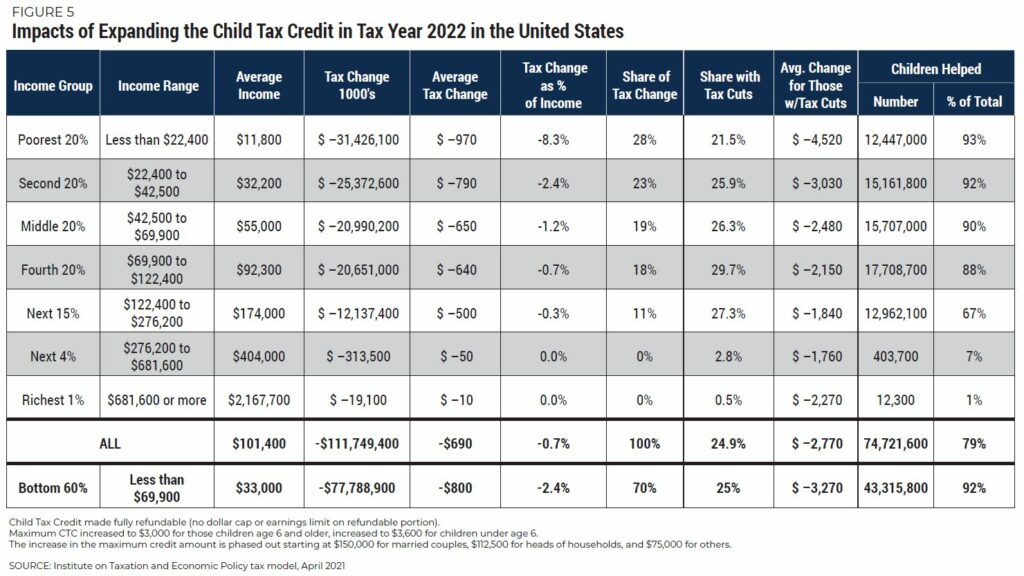

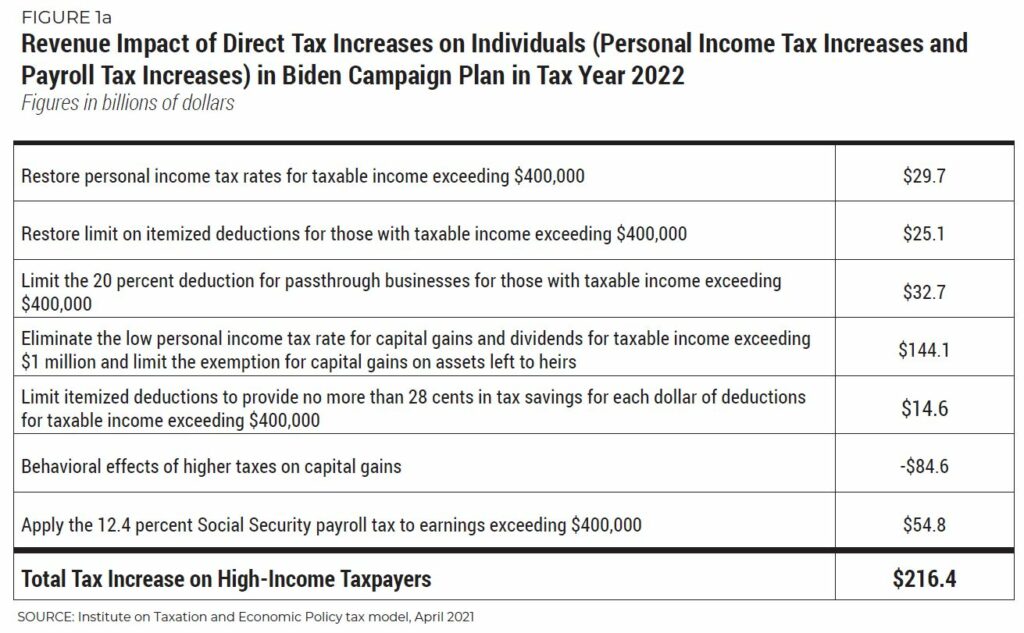

National And State-by-state Estimates Of President Bidens Campaign Proposals For Revenue Itep

National And State-by-state Estimates Of President Bidens Campaign Proposals For Revenue Itep

What Are Payroll Deductions Pre-tax Post-tax Deductions Adp

Massachusetts Income Tax Hr Block

2

Santa Clara County Ca Property Tax Calculator - Smartasset

Massachusetts Paycheck Calculator - Smartasset

This Is The Ideal Salary You Need To Take Home 100k In Your State

What Are Payroll Deductions Pre-tax Post-tax Deductions Adp

Massachusetts Inheritance Laws What You Should Know - Smartasset

/cdn.vox-cdn.com/uploads/chorus_asset/file/19915691/93151637_2771087436293879_2468457111059693568_n.jpg)

Massachusetts Distillers Petition State To Deliver During Pandemic - Eater Boston

National And State-by-state Estimates Of President Bidens Campaign Proposals For Revenue Itep

National And State-by-state Estimates Of President Bidens Campaign Proposals For Revenue Itep

What Are Payroll Deductions Pre-tax Post-tax Deductions Adp

2