Illinois Electric Car Tax Credit 2020

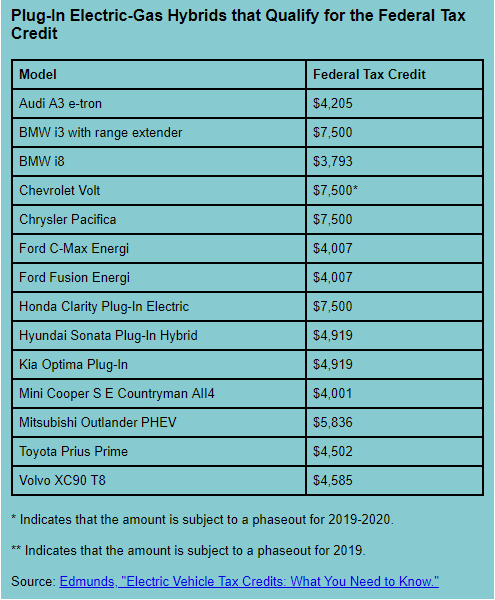

By 2020 the subsidy will be zero dollars for tesla. A buyer of a new electric car can receive a federal tax credit between $2500 and $7500.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Compare the costs of driving on electricity with egallon.

/cdn.vox-cdn.com/uploads/chorus_image/image/70149942/Screen_Shot_2021_11_16_at_10.43.05.0.png)

Illinois electric car tax credit 2020. The official end of its vehicles’ eligibility for federal tax credits. The amount of the tax credit ranges from $2,500 to $7,500, depending on the size of your battery. Likewise, the credit for leasing an ev will decrease to $1,500 from the current $2,000.

At tesla, the electric vehicle maker, january 1, 2020 will mark something else: Registration fees for il electric vehicles. Illinois collects a 7.25% state sales tax rate on the purchase of all vehicles.

Most new evs are eligible for up to a $7,500 federal tax credit. Additionally, illinois offers larger rebates for dual and fast charge stations. Visit fueleconomy.gov for an insight into the types of tax credit available for specific models.

No emissions checks for all electric vehicles: In addition to state and county tax, the city of chicago has a 1.25% sales tax. Pay less at the plug:

A buyer of a new electric car can receive a tax credit valued at between $2,500 and $7,500. State and/or local incentives may also apply. The amount of credit you are entitled to depends on the battery capacity and size of the vehicle.

Jb pritzker signed illinois’ clean energy law on wednesday, which includes a $4,000 rebate for residents to buy an electric vehicle (ev). There is also between a 0.25% and 0.75% when it comes to county tax. The amount is determined by the power storage of the battery.

The taxes can be different in the case of a. If you are expecting to owe $5,000 in taxes, but file for a $7,500 credit from a recently purchased electric car, you would expect to see $5,000, eliminating the difference of $2,500). There are programs providing separate rebates and/or tax credits for both ev cars (including tesla models, chevrolet bolt, nissan leaf or even hybrid models, such as toyota prius and ford hybrid) and ev charging stations.

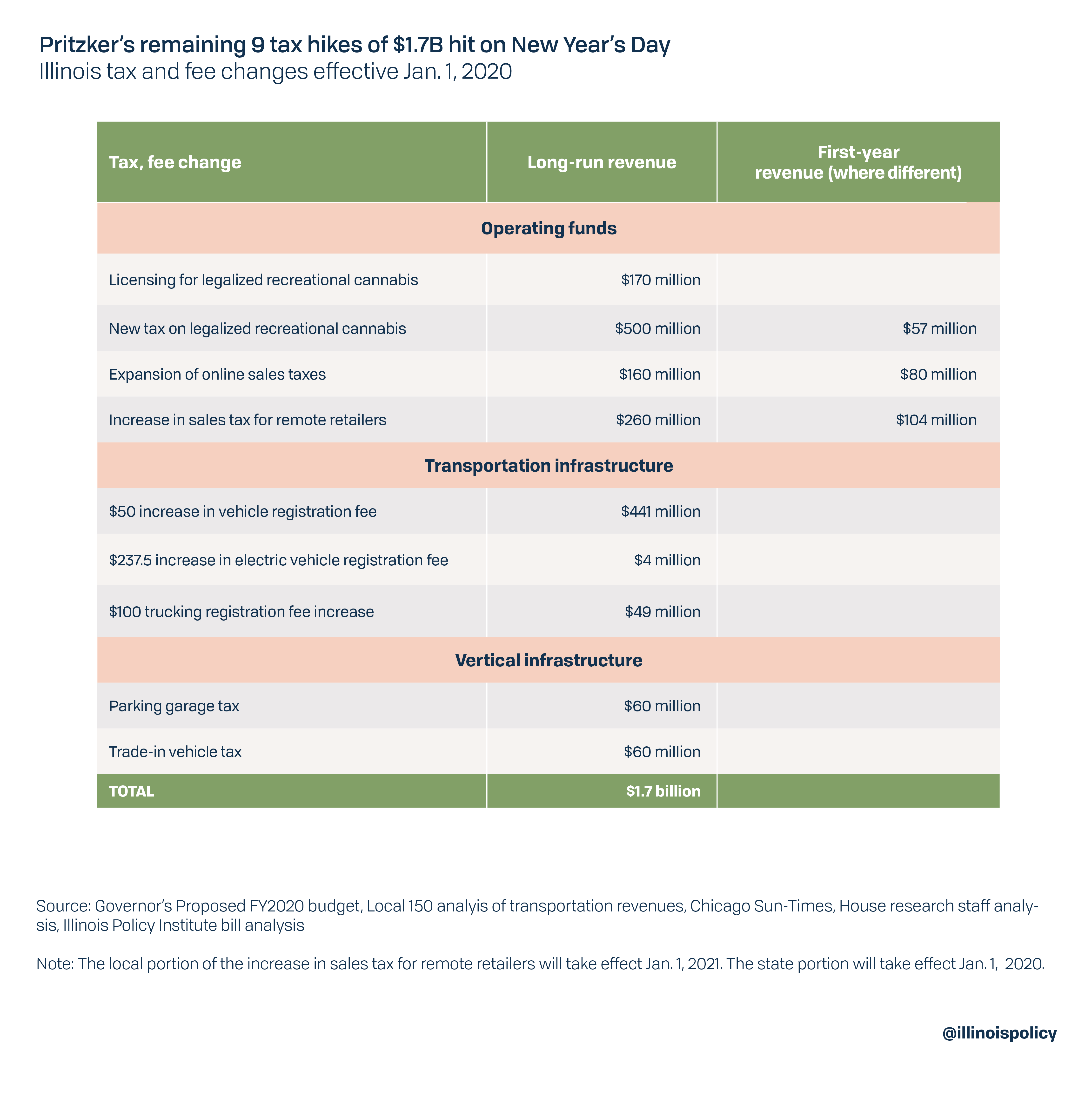

How much is the electric vehicle tax credit? The credit amount will vary based on the capacity of the battery used to power the vehicle. It turns out the bill also hikes the registration fee to $148 for all vehicles, but to $248 for evs specifically.

Small neighborhood electric vehicles do not qualify for this credit, but they may. Note that in some events new electric vehicles must be purchased from a licensed auto dealer. The specific amount of your tax credit is determined by the.

There is no tax credit if you decide to lease a new electric vehicle. Some hybrid electric vehicles have smaller batteries and don’t quality for the maximum tax credit amount. The tax is imposed on persons distributing, supplying, furnishing, or selling electricity in illinois for use and consumption (not for resale).

There also may be a documentary fee of 166 dollars at some dealerships. 56 rows tax credits for heavy duty electric vehicles with $25,000 in credit. Illinois vehicle registration fees for electric cars is $251 per registration.

The illinois secretary of state vehicle services department offers specific vehicle registration fees to residents who drive an electric vehicle (ev). Federal tax credit up to $7,500! The federal ev tax credit is the first to run out for electric carmaker tesla on dec.

The cost of fueling an ev is less than half that of a conventional vehicle. Learn more on this and how to obtain ev license plates below. Vehicle registration fees for illinois electric vehicles.

Year in gifts tech life social good entertainment deals How much is the electric vehicle tax credit worth? How much is the ev tax credit?

There’s some consternation among ev advocates about the imminent reduction of the state’s tax incentive, but stefan johnson, transportation program manager at clean energy economy for the region (cleer) , sees both sides. So the “ev tax” is $100, not $248) the illinois legislature has approved a. This irs tax credit can be worth anywhere from $2,500 to $7,500.

Here are the currently available eligible vehicles.

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green - Pkf Mueller

Illinois Aims To Put 1 Million Electric Vehicles On The Road By 2030

Electric Car Tax Credits Whats Available Energysage

Illinois Boosts Tax Incentives For Electric-car Ev Makers Crains Chicago Business

Questions About Buying Owning Electric Vehicle Answered Belleville News-democrat

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Illinois Ridiculous 1000 Ev Tax Is No More Imposes 100 Ev Tax Instead Updated - Electrek

/cdn.vox-cdn.com/uploads/chorus_image/image/70149942/Screen_Shot_2021_11_16_at_10.43.05.0.png)

Pritzker Signs Electric Vehicle Legislation Aims To Make Illinois A Leader In Clean Transportation Revolution - Chicago Sun-times

What Illinois Green Energy Law Means For Electric Car Buyers

Electric Vehicle License Plates

Proposed Ev Tax Credit Boost 12500 For Union Labor And Us-made

States That Charge Extra Fees To Own An Electric Vehicle

Illinois Electric Vehicle Goal 1 Million By 2030 Wbez Chicago

Trump Wants To Kill 7500 Electric-car Tax Credit

Why Illinois Wants To Give Ev Makers Huge Tax Breaks Automotive News

Latest On Tesla Ev Tax Credit December 2021 - Current And Upcoming In 2022

Illinois Electric Vehicle Goal 1 Million By 2030 Wbez Chicago

9 New Illinois Taxes Totaling 17b Take Effect Jan 1

Illinois Leaders Hope This New Law Will Draw More Electric Vehicle Factories To The State Stlpr