Corporate Tax Increase Canada

Without the general tax reduction, the basic rate of part i tax is 38%. At budget 2020, the government announced that the corporation tax main rate (for all profits except ring fence profits) for the years starting 1 april 2020 and 2021 would be.

The Daily Effective Tax Rates And High Income Canadians 2016

Joe biden’s plan to raise u.s.

Corporate tax increase canada. For more on corporate tax rates , see the canada revenue agency's (cra's) corporation tax rates , which includes a list of income tax rates for provinces and territories. One of canada’s most important positive policy reforms over the past 15 years has been on corporate taxes. For other types of corporations in canada, the corporate tax rate is 15% after the general tax reduction.

Corporate tax rates would increase the competitive corporate tax advantage canada already enjoys relative to the u.s., should the democratic candidate win the u.s. The reduced rates will be in place from 2022 through 2028, after which they will progressively As of january 1, 2019 the net tax rate after the general tax reduction is fifteen per cent.

9% effective january 1, 2019 10% effective january 1, 2018 Dividends received from canadian corporations are deductible in computing regular part i tax, but may be subject to part iv tax, calculated at a rate of 38 1/3%. Corporate tax rates in canada’s provinces and territories;

To help canadians in the future, the canada revenue agency is taking out increasing cpp premiums from 2019 to 2023. In december 2015, canada’s new liberal government introduced changes to canada’s personal income tax system. Corporate tax rate in canada is expected to reach 26.50 percent by the end of 2020, according to trading economics global macro models and analysts expectations.

Federal and provincial governments of all political stripes realized the economically damaging effect of corporate income taxes and lowered rates to make the business tax regime more competitive. Canada's corporate tax base has grown for two reasons. For nonresident corporations, the general corporation rates in the table apply to business income attributable to a permanent establishment in canada.

This increase in the federal tax rate is layered on top of. Raising corporate taxes is bad economic policy. No news here, folks, unless you are interested in picking up some tricks on how to present statistics in a way that makes the growth of a spending item of your choice.

The fraser institute’s alarm over tax increases captures the tax increase over the 1960s, when many of canada’s core social programs, such as medicare, were first established. Add the federal and provincial/territorial tax rates for a combined federal and provincial rate. Howe institute has been advocating for.

(5) corporations that are ccpcs throughout the year may claim the small business Each annual increase is small, but it adds up to a 16.7% hike over the five years of enhancement. Corporate taxes in canada are regulated at the federal level by the canada revenue agency (cra).

For 15 years straight, canada has raised more corporate tax revenue than the u.s., as a share of gdp. As canada’s big banks report massive profits this week, prime minister justin trudeau is pledging to impose higher taxes on financial institutions’ earnings. See mark parsons, “the effect of corporate taxes on canadian investment:

General corporate tax rate of 15% would otherwise have applied, and 4.5% where the small business tax rate would otherwise have applied. Among the changes for the 2016 tax year, the federal government added a new income tax bracket, raising the top tax rate from 29 to 33 percent on incomes over $200,000. Corporate tax revenue as a share of gdp has averaged 2.3 percent, compared to 3.3.

Bc Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Nelson Star

Is The Us The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

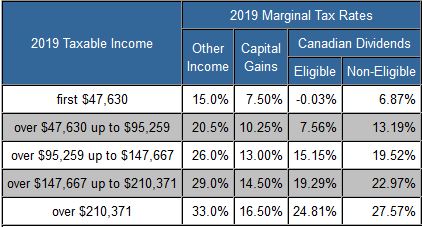

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Taxtipsca - 2021 Sales Tax Rates - Pst Gst Hst

Income Tax Rates For The Self-employed 2020 2021 Turbotax Canada Tips

Taxtipsca - Manitoba 2021 2022 Personal Income Tax Rates

Taxtipsca - Ontario 2019 2020 Income Tax Rates

How Do Taxes Affect Income Inequality Tax Policy Center

Taxtipsca - Business - 2020 Corporate Income Tax Rates

At A Glance Treasurygovau

How Much Does A Small Business Pay In Taxes

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Taxtipsca - Canadas Top Marginal Tax Rates By Provinceterritory

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Taxtipsca - Federal 2018 2019 Income Tax Rates

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Pin On Data Journalism

Canadas Federal Personal Income Tax Brackets And Tax Rates 2021 Turbotax Canada Tips