Corporate Tax Increase Us

As part of his $2 trillion american jobs plan, president joe biden is proposing an increase of the corporate tax rate to 28% from its current 21%. His administration appears well aware that one element that would make their efforts easier — or at the very.

Progressive Tax Definition Taxedu Tax Foundation

Biden’s proposal would increase the u.s.

Corporate tax increase us. The us move during the week of the imf and world bank spring meetings comes as the white house has also called for raising us corporate taxes. This means the costs of bad policy are higher than ever before, and it also means the benefits of good policy are higher than ever before. Corporate tax rate to 26.5% from the current rate of 21%.

Biden’s infrastructure plan proposes increasing the corporate tax rate to 28% from 21% and would revise the tax code to close loopholes that allow companies to. Corporations in china pay a standard corporate tax rate of 25%, while some industries in the. New law scraps planned corporate tax cut;

March 17, 2021 by dan mitchell. He wants to raise their basic tax rate from 21% to 28%. The rate was cut from 35% in 2017 under biden’s predecessor, donald trump.

The global average for the corporate tax rate is 23%. A corporate tax hike won’t help us build back better. For budgetary reasons, policymakers could not make all of the 2017 law’s tax cuts permanent.

Federal corporate income tax changes are relatively rare, but with 50 states there is a lot of change and variation at the state level. Vat to rise to 11% in april, from 10%; The chancellor has confirmed an increase in the corporation tax (ct) rate from 19 to 25 percent with effect from 1 april 2023.

Biden says he wants to raise the corporate income tax rate from 21% to 28%. Biden also aims to increase the us corporate tax rate from 21 percent to 28 percent. Corporations by raising the corporate income tax rate to 28 percent, levy a new 15 percent minimum book tax on corporations with over $100 million in book income, and impose tax penalties for certain offshoring activity.1 as president biden and congress decide how to modify the tax code to raise additional revenue

Biden’s tax proposal in infrastructure plan would hurt the us against competitors like china. Companies are doing exceptionally well and can afford to pay a higher tax rate for a couple of years. The recent proposals by biden to raise the corporate tax in the us back a little, from trump’s 21% to 28%, would have contributed to reversing the trend.

The tax would apply only to companies that publicly report. A 30% tax rate won. What biden’s corporate tax increase means for american competitiveness.

Thanks to globalization (as opposed to globalism ), jobs and investment are now very mobile. The government should use this opportunity to raise corporation tax rates; Corporate tax rate is the highest in the developed world, at 39 percent including state corporate taxes.

House democrats are expected to propose raising the corporate tax rate to 26.5% from 21% as part of a sweeping plan that includes tax increases on the wealthy, corporations, and investors. Companies with profits between £50,000 and £250,000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in. Increase the tax burden on u.s.

Multinationals, he plans to increase taxes on their foreign earnings from 10.5% to 21%. Higher income tax for the rich, carbon tax, amnesty approved New details of a democratic plan to enact a 15% minimum corporate tax on declared income of large corporations were released tuesday.

A compromise proposal to raise it to 25% now also appears to be unlikely. He has also proposed a 15% minimum tax he wants to apply to all corporations — a catchall to prevent companies from lowering their tax payments to zero. The corporate tax increase proposal in the.

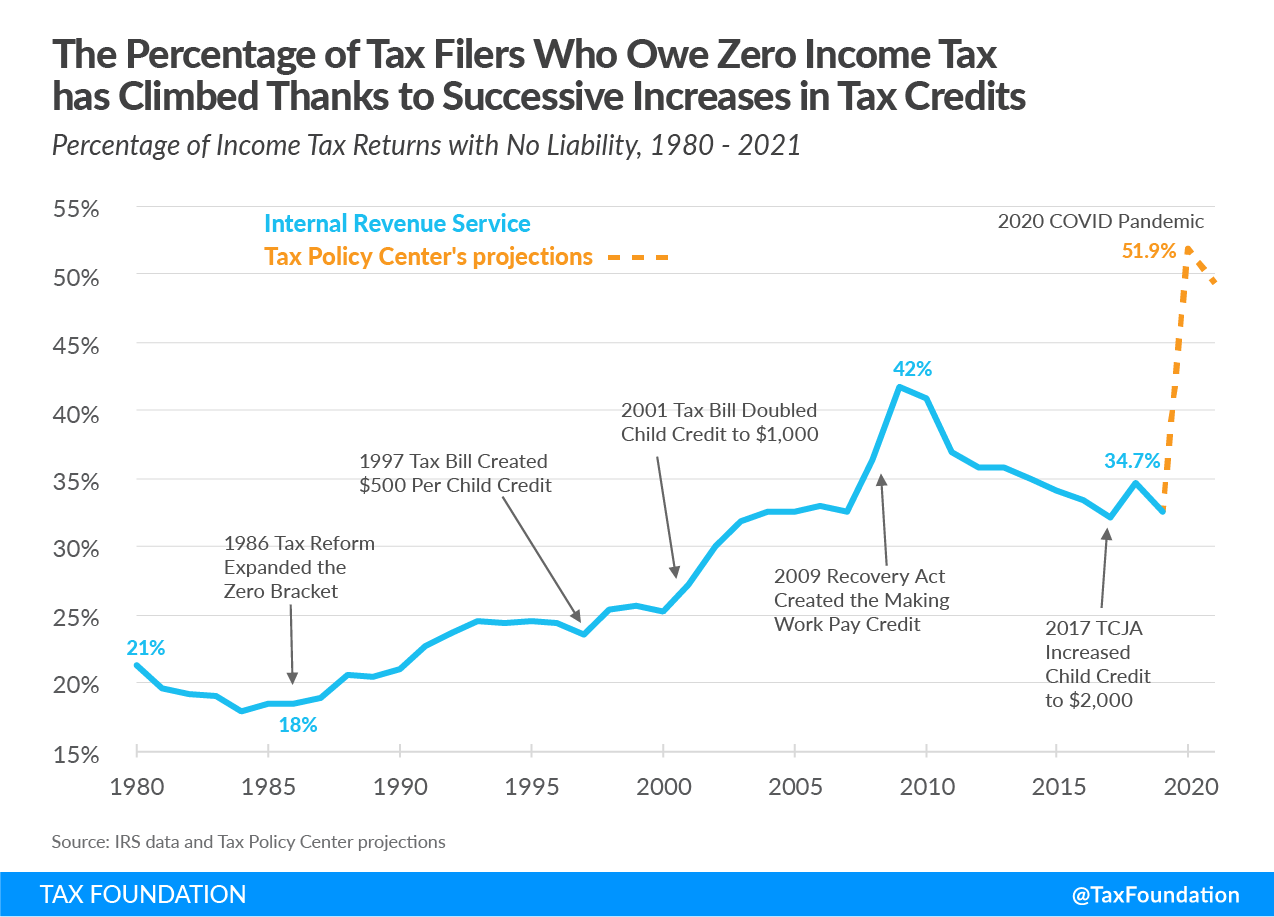

Increasing Share Of Us Households Paying No Income Tax

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Income Tax History Tax Code And Definitions United States

Us Corporate Tax Rate Compared To Other Countries Business Infographic Small Business Infographic Infographic

The Dual Tax Burden Of S Corporations Tax Foundation

How Progressive Is The Us Tax System Tax Foundation

What Stock Market History Tells Us About Corporate Tax Hikes In 2021 Stock Market Stock Market History Corporate Tax Rate

25 Percent Corporate Income Tax Rate Details Analysis

Progressive Tax Definition Taxedu Tax Foundation

What Stock Market History Tells Us About Corporate Tax Hikes In 2021 Stock Market Stock Market History Corporate Tax Rate

A Brief History Of The Individual And Corporate Income Tax Income Tax Income Financial Health

Buffett Lost 90 Billion By Not Following His Own Advice Seeking Alpha Old Quotes Stock Index Corporate Tax Rate

Face The Facts 2 Ask For The Corporate Rate Or Not Corporate Corporate Tax Rate Facts

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains Tax 101

Corporate Inversion Is A Form Of Tax Avoidance And Its Driven By The Fact That Us Corporate Tax Is Not Only The High Income Tax Developing Country Corporate

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

How Progressive Is The Us Tax System Tax Foundation

Income Tax History Tax Code And Definitions United States