Free Crypto Tax Calculator Usa

Whether you are filing yourself, using a tax software like turbotax or working with an accountant. Straightforward ui which you get your crypto taxes done in seconds at no cost.

How To Calculate Costs Basis In Crypto Bitcoin Koinly

The us crypto tax calculator.

Free crypto tax calculator usa. At zenledger, you can use our crypto tax calculation software to simplify tax reporting and financial analysis in compliance with the irs and the sec rules and regulations. It was developed with the. Treat as 1) sell cryptoa for fiat and 2) buy cryptob with same amount of fiat at the same time.

Crypto.com announced the launch of a crypto tax calculator. We are excited to announce new pricing that enables beginner cryptocurrency users to automatically calculate their taxes for free. To measure the crypto taxes the apps like koinly which is a free online crypto tax calculator can be used.

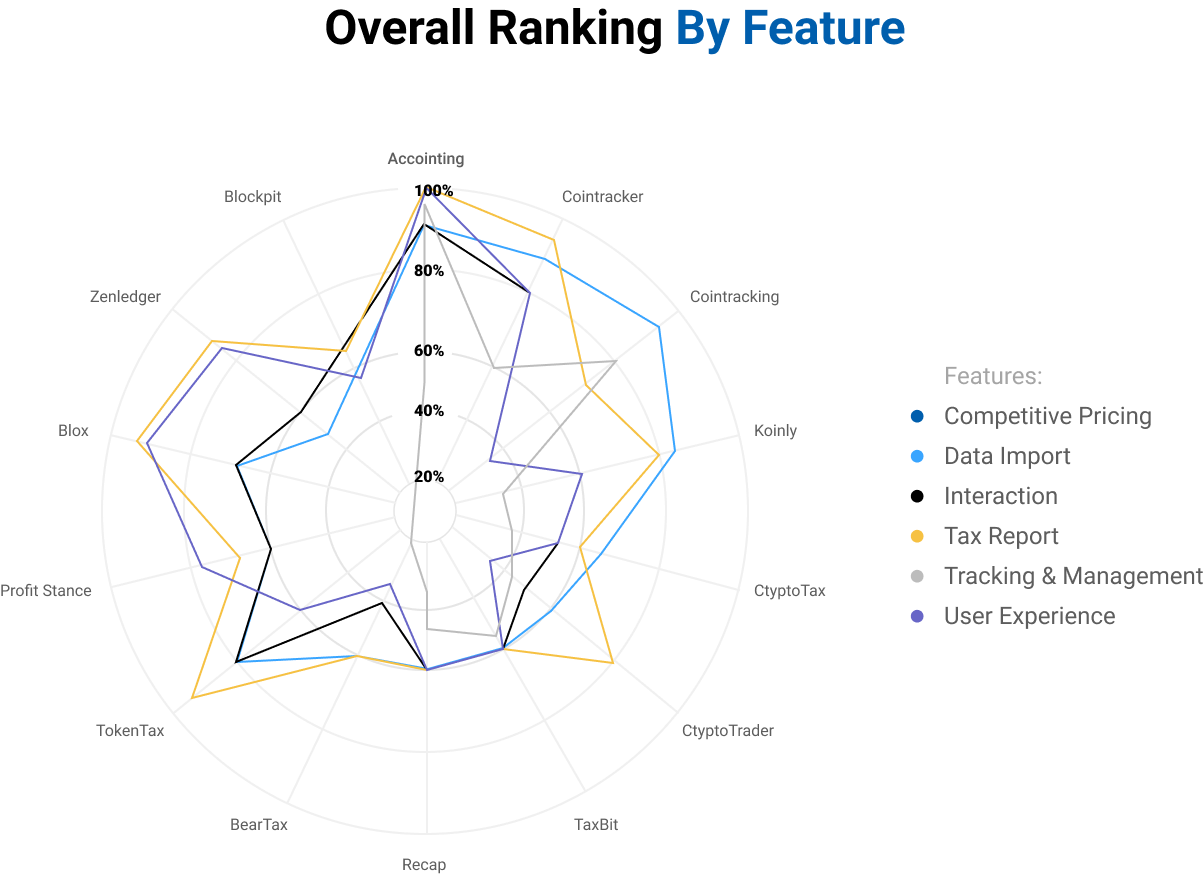

This is especially true when it comes to the usa. Let’s get to the final step of understanding us crypto taxes by learning how to report cryptocurrency taxes. Best crypto tax reporting and calculation software:

Koinly can generate the right crypto tax reports for you. The way cryptocurrencies are taxed in the united states mean that investors might still need to pay tax, regardless of if they made an overall profit or loss. These profits are taxed at different rates.

Contact a tax professional if you don't know how to calculate crypto taxes or for any other questions. Jane’s estimated capital gains tax. You won't pay tax when you buy crypto, hold crypto, or move your crypto between wallets.

Your taxes are shown in the “ main ” sheet. Calculate and report your crypto tax for free now. Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position.

The crypto.com tax service is currently only available in canada but will soon be available in other markets. Select the tax year you would like to calculate your estimated taxes. Crypto.com tax offers the best free crypto tax calculator for bitcoin tax reporting and other crypto tax solutions.

It has a smooth and instinctive ui and is ideally suited for both established traders and unskilled blockchain fans holding comparatively smaller numbers of cryptocurrencies. Torsten hartmann november 1, 2021 0. In general terms, losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

The tax rate on this particular bracket is 32.5%. The original software debuted in 2014. Select your tax filing status.

0.325 * $5,000 = $1,625. Cryptotrader.tax is a tax software offering quick process, free previews of tax reports, international support, and is a partner of turbotax. As with every income in life, cryptocurrency income is also taxed in many nations.

Depending on your circumstances, taxes are usually realised at the time of the transaction, and not on the overall position at the end of the financial year. Reporting cryptocurrency on your taxes. With over 300,000 users, cointracking.info is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

20 are subject to tax. We have created the most accurate bitcoin and crypto tax calculator in the market for us citizens that want to file their yearly income and taxable gains to. Jan 21, 2020 • 2 min read.

For most people, this is the same as adjusted gross. Tokentax is one of the most extensive tax calculation and reporting software out there for any crypto trader. Starting today, cryptocurrency users with up to 25 transactions in a given tax year can use cointracker to calculate cryptocurrency taxes free of charge.

Since then, its developers have been creating native apps for mobile devices and other upgrades. On the “ tax ” sheet, insert your chronological crypto trades data as seen in the example ( columns a, c, and f ). Cryptocurrency is viewed as property and is taxed in the united states as either capital gains tax or income tax.

Our step by step wizard and cryptocurrency tax calculator is fine tuned for new zealand and will help you figure out your crypto tax position to declare. Enter your taxable income excluding any profit from bitcoin sales. Full integration with popular exchanges and wallets in canada with more jurisdictions to come.

For the purpose of estimating jane’s cgt tax on her crypto asset alone, we then apply this 32.5% tax rate to the $5,000 capital gain included in jane’s assessable income.

Discover Why The Gold Rate In Usa Is Skyrocketing Cryptocurrency Bitcoin Chart Buy Bitcoin

Bitcoin Machine Bitcoin Machine Chicago - Bitcoin Mining App Iosbitcoin Forum Bitcoin Will Fail How To Create Your Own Cryp Buy Bitcoin Cryptocurrency Bitcoin

Free Bitcoin Tax Calculator Crypto Tax Calculator Taxact Blog

Crypto Tax Calculator File Cryptocurrency Taxes Tokentax

![]()

Cointracking - Crypto Tax Calculator

![]()

Cointracking - Crypto Tax Calculator

What Is The Most Efficient Way To Calculate Crypto Tax Tax Software Calculator Tax

Discover Why The Gold Rate In Usa Is Skyrocketing Buy Bitcoin Cryptocurrency Bitcoin Cryptocurrency

For Crypto Owners Looking To Estimate How Much They Owe In Taxes There Are Some Platforms With A Free Crypto Tax Calculator They Integrate With Major Crypto E

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Goldratesnowcom Bitcoin Mining Bitcoin What Is Bitcoin Mining

Pin On Bitcoin

Best Crypto Tax Software In 2021 Coinmonks

Bitcoin Wallet Online Opus Cryptocurrency - Schwab Buy Bitcoinbest Way To Invest In Bitcoin Bitcoin Telegram Bi Bitcoin Mining Bitcoin Mining Pool Buy Bitcoin

Cryptoreports - Google Workspace Marketplace

Crypto Tax Calculator

Free 10 Usd In Btc For Every New Member Httpsbonus-coinbasecom Coinbase Wallet Offer Bonus Bitcoin Btc Bitcoin Cryptocurrency Virtual Currency

Discover Why The Gold Rate In Usa Is Skyrocketing Buy Cryptocurrency Cryptocurrency Bitcoin