Geothermal Tax Credit Extension

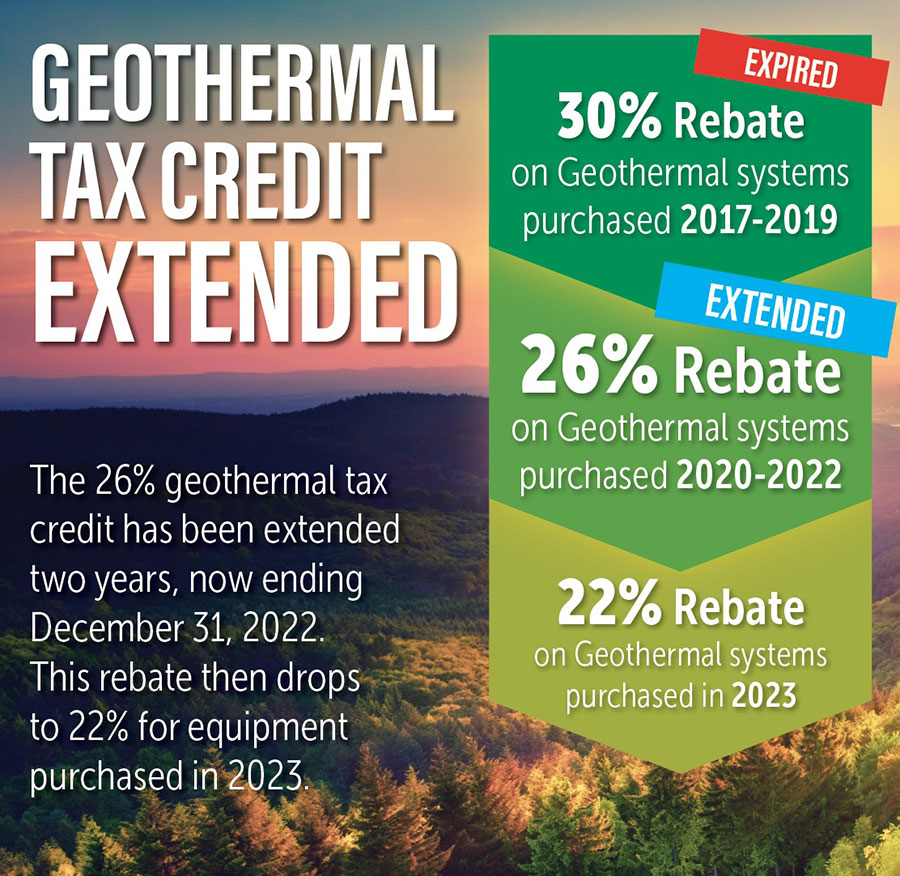

Existing tax credits were set at 26% throughout 2020, 22% throughout 2021, and falling to zero at the end of 2021. However, if the system is part of the construction or renovation of a house, it’s considered placed in service when the taxpayer takes residence in the house.

Geothermal Rebates Extended - Corken Steel Products

The credits have been extended through 2023.

Geothermal tax credit extension. Tax credits for geothermal extended to 2023! On december 17, 2019, the united states house of representatives passed the tax extenders package, allowing geothermal projects that begin construction before the end of. Property is usually considered to be placed in service when installation is.

Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets energy star requirements at the time of installation is eligible for the tax credit. The credit then steps down to 22% in 2023 and expires january 1, 2024. These tax credits were initially introduced as part of the energy improvement and extension act of 2008, but with the exception of solar and wind energy credits the tax benefits ended at the close of 2016.

This geothermal heat pump tax credit was created by the energy improvement and extension act of 2008 (h.r. Unless amended, the tax credit will extend until 31 december 2016. Since geothermal systems are the most efficient heating and cooling units available, the united states federal government has enacted a 26% federal geothermal tax credit with no upper limit.

This would mean a 30% tax credit through 2024 , a 26% tax credit in 2025, and a 22% tax credit in 2026. The recently signed federal budget and stimulus bill includes an extension of the federal geothermal heat pump (ghp) tax credits through 2023. In december 2020, the tax credit for geothermal heat pump installations was extended through 2023.

From 2017 to january of 2018 there was an ongoing fight to extended this tax credit. While the bill mainly targets homeowners, small business and commercial owners may be eligible for a 10% tax credit for their geothermal heat pump investment. The new law extends the credits for ghp installations through 2023.

The energy efficiency property tax credit (residential credit) for ghps is extended for two years at its current level of 26% of total installation cost. “we heard from leaders afterward that it was a mistake and that there would be a willingness to bring geothermal technologies in line, in parity, with what solar and wind got,” dougherty said. in december 2020, the tax.

Help extend the geothermal 30% tax credit through 2024! The new legislation lengthens the deadline for the credits for ghp installations. A 30% tax credit for the installation of a ground source heat pump (geothermal system) with no cap was enacted in 2009.

The recently signed federal budget and stimulus bill includes an extension of the federal geothermal heat pump (ghp) tax credits through 2023. The extension keeps the tax credit at 26% for residential geothermal for 2021 and 2022. The federal tax credit for geothermal installations was extended for two more years at the end of 2020.

This tax credit was available through the end of 2016. The energy policy act of 1992 (p.l. In december 2020, the tax credit for geothermal heat pump installations was extended through 2023.

Residential credits are 26% through 2022, step down to 22% in 2023, and expire january 1, 2024. The tax credits for solar and geothermal, as did the tax extension act of 1991 (p.l. The 26% federal tax credit was extended through 2022 and will drop to 22% in 2023 before expiring altogether, so act now for the most savings!

As we mentioned last week, this legislative package includes an extension for commercial and residential geothermal heat pump (ghp) tax credits. Extension for commercial and residential geothermal heat pump (ghp) tax credits. See our announcement from last week here.

The energy efficiency property tax credit (residential credit) for ghps is extended for two years at its current level of 26% of total installation cost. This legislative package contains an. On december 17, 2019, the united states house of representatives passed the tax extenders package, allowing geothermal projects that begin construction before the end of 2020 to claim ptcs when the project is later placed in service, or to elect to.

Geothermal tax credit explanation property is usually considered to be placed in service when installation is complete and equipment is ready for use. Congress recently approved an extension of federal tax credits for both residential and commercial installations of geothermal heat pumps (ghps) and several other alternative energy based solutions.

Oklahomas Geothermal Tax Credit Extension Explained Dehart Ok

Pdf Tax Incentive Policy For Geothermal Development A Comparative Analysis In Asean

Congress Gets Renewable Tax Credit Extension Right - Renewable Energy World

Congress Gets Renewable Tax Credit Extension Right - Renewable Energy World

Geothermal Investment Tax Credit Extended Through 2023

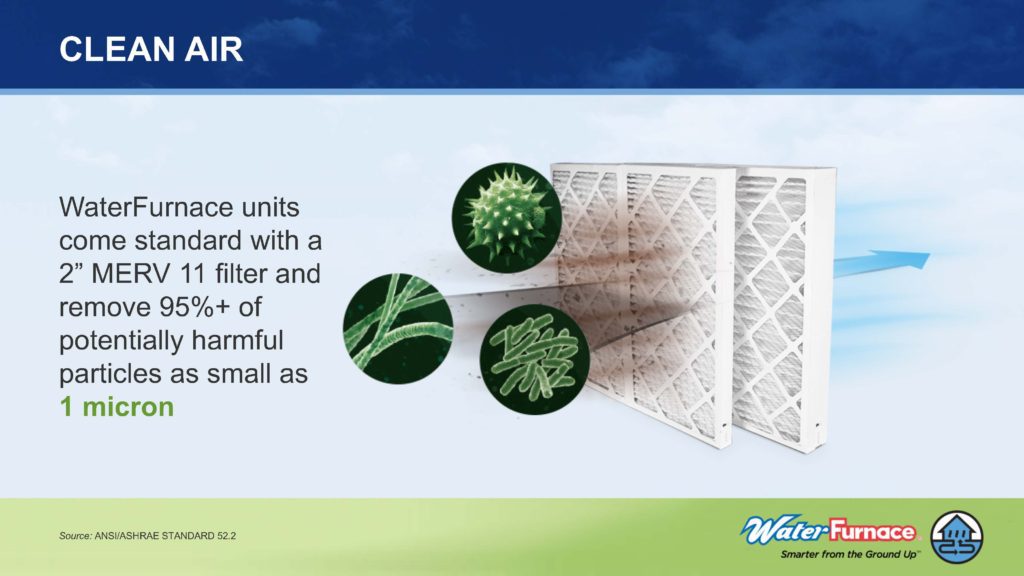

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

Geothermal Tax Credits Extended Smart Choices

What Is The 2021 Geothermal Tax Credit - Climatemaster Geothermal Hvac

Pdf Tax Incentive Policy For Geothermal Development A Comparative Analysis In Asean

Geothermal Heat Pump Tax Credits Approved By Congress - Geothermal Heating And Cooling Chesapeake Geosystems

What Is The 2021 Geothermal Tax Credit - Climatemaster Geothermal Hvac

The Extended 26 Solar Tax Credit Critical Factors To Know

What Federal Tax Incentives Are There For Geothermal Heat Pumps

Understanding The Geothermal Tax Credit Extension

Newsletter

House-passed 17 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

The Federal Geothermal Tax Credit Your Questions Answered

Pdf Tax Incentive Policy For Geothermal Development A Comparative Analysis In Asean

What Federal Tax Incentives Are There For Geothermal Heat Pumps