Marin County Property Tax Exemptions

Limited income seniors who have lived in their current home for 25 years or more This would result in a savings of approximately $70 per year on your property tax bill.

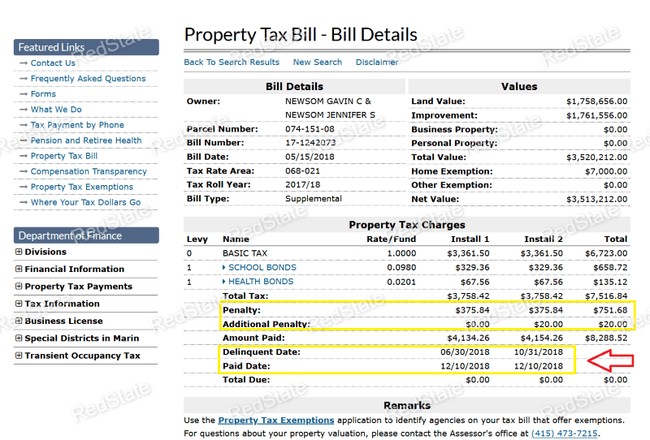

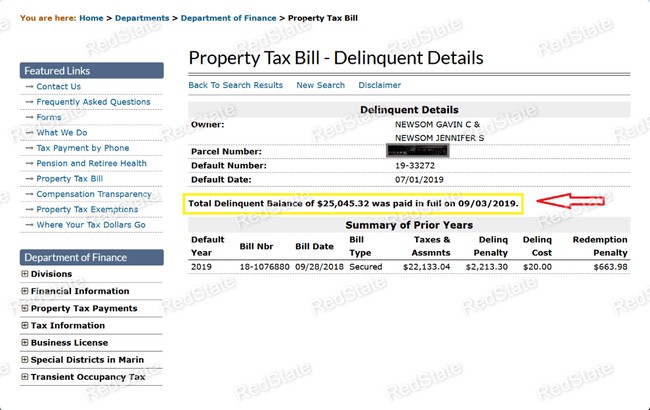

Gavin Newsoms Property Taxes Are Chronically Delinquent And Theres No Excuse Redstate

There is also a full list of such exemptions countywide.

Marin county property tax exemptions. If you are over the age of 65 and use the property as your principal residence, you may be eligible for a parcel tax exemption. These are deducted from the assessed value to give the property's taxable value. The marin county department of finance says it's just the tax collector.

Marin county property tax exemptions for seniors. By applying for the homeowners exemption, you can save approximately $70 on your property taxes each year. 2 of the marin county free library district (for measure l) or the town of corte madera (for measure k), and earn a total annual household income of not more than 80% of the median.

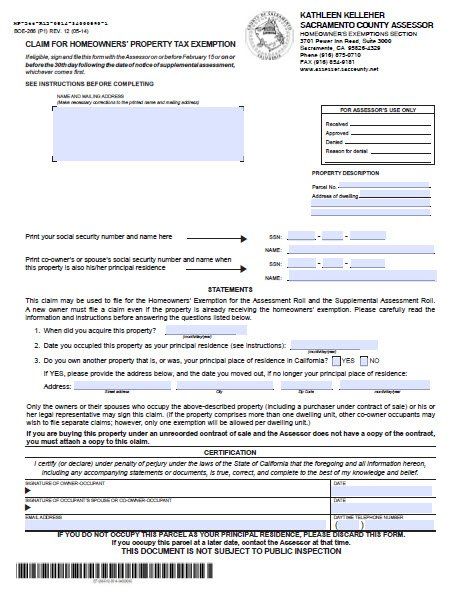

Residents of the state of florida age 65 or older may carry proof of their age and residency, such as a drivers license or voter registration. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. All homeowners in marin county may be eligible for a $7,000 exemption on the assessed value of their primary home.

The responsibility for informing people about exemptions is with each of the 153 special tax districts. In marin county there are 2 boards each made up of 3 members appointed by the board of supervisors. Located in the measure a tax zone of the marin county free library district.

The following schedule lists some of the more significant dates for california property taxes affecting property owners and other interested parties. Parcels which are classified by county assessor use codes 12 (mobile home) and 13 (house boat) are exempt from this parcel tax. Boats used exclusively for commercial fishing, research or as a party boat may qualify for special valuation at 4% of their normal market value.

There are many provisions of the property tax laws (propositions 60, 90, and 100) that cover all of the details. Spouses of veterans killed in active duty are eligible for the same benefit. ·determines the assessed value of local real, business, personal.

·administers assessor’s parcel map program. ·administers property tax exemptions including; Skip to first unread message.

Exemptions are available in marin county which may lower the property's tax bill. The homeowner’s exemption reduces the annual property tax bill for a qualified homeowner by at least $70. Taxes and assessments section provides detailed information on new tax information, exemptions and exclusions that are available and information on how to have your home or property reassessed.

This section also provides direct links to downloadable and printable forms to help file your property taxes. The eligibility requirements for the original $25,000 homestead exemption must be met to be eligible for other exemptions. Residents age 65 or older may obtain, at no cost, complimentary hunting and fishing licenses from county tax collectors’ offices.

Pay by mail postmarked by friday, april 10, 2020. Including boats and aircraft for property taxation. Box 4220, san rafael ca 94913.

To receive the full homeowner’s exemption, the property owner must reside on the property january 1, and file the homeowner’s exemption claim form with the marin county assessor’s. Only boats owned and held in inventory for sale by a licensed dealer are exempt from property taxes. Limited income senior exemption for persons 65 and older;

That senior citizen's lucky savings inspired the grand jury to investigate other property tax exemptions, and urge county tax officials to. Please contact the districts directly at the phone numbers located under your name and address on the front of your property tax bill for exemption eligibility requirements, or visit: An assessment appeals board (aab) is an independent agency separate from the county assessor’s office whose primary function is to conduct impartial hearings on property assessment disputes between taxpayers and the county assessor.

Marin county’s property tax exemption webpage has a lot of the information you need for most, but not all, of the taxes and fees that could impact you. If you enter your parcel number, the website pulls up a list of all the exemptions for which you are eligible that show up on your tax bill. Senior citizen exemptions for hunting and fishing license exemptions.

Marin-county Property Tax Records - Marin-county Property Taxes Ca

Gavin Newsoms Property Taxes Are Chronically Delinquent And Theres No Excuse Redstate

Property Tax Exemption For Live Aboards

Marin County Mails Property Tax Bills Seeking 126b

Marincountyorg

Marin Wildfire Prevention Authority Measure C Myparceltax

Transfer Tax - Who Pays What In Marin County California

Appsmarincountyorg

Property Tax Bills On Their Way

Capropeformsorg

Cpc-marin-county-discloses-debt-on-prop-tax-bills-bill Cleo

Marincountyorg

Tomalescsdcagov

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

Property Tax Bills Sent To Marin County Residents San Rafael Ca Patch

County Of Marin - Department Of Finance - Where Your Property Tax Dollars Go

Marin County Discloses Debt Balances On Property Tax Bills

Transfer Tax - Who Pays What In Marin County California

Think Dallas-fort Worth Property Taxes Are High Well Youre Right