Oregon Statewide Transit Tax 2021 Rate

Tax rate used in calculating oregon state tax for year 2021. 2021 oregon tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Oregon Statewide Transit Tax

2021 massachusetts rate exchange update

Oregon statewide transit tax 2021 rate. Return and payment are due by july 31, 2021. The current rate should be printed in the trimet/ltd portion of the oregon quarterly combined tax report (form oq). The 2021 wbf assessment rate is $.022/hr.

Employers must begin withholding 0.1% oregon statewide transit tax from: The oregon transit tax is a statewide payroll tax that employers withhold from employee wages. For proper oregon tax withholding,.

The wilsonville transit tax will remain unchanged at.005. The tax rate is 0.10 percent. The worker's/employee's portion is only 1/2 ( $.011/hr ) of the assessment rate.

For the current rate, see the rate table at the bottom of this page. This tax must be withheld on: Oregon employers must withhold 0.1% (0.001) from each employee’s gross pay.

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower Withhold the state transit tax from oregon residents and nonresidents who perform services in oregon. And (3) periodic pension payments made to.

It helps pay for highways and mass transit programs around the country. Return and payment are due by april 30, 2021. How to figure the transit tax multiply the gross taxable payroll earned within the transit district by the current transit rate.

The transit tax will include the following: The futa rate after the credit is 0.6%. Return and payment are due by october 31, 2021.

The department of consumer and business services has set the wbf assessment rate for calendar year 2021 at 2.2 cents per hour. The wages of oregon residents the wages of nonresidents who perform services in oregon. Wages exempt from transit payroll tax 150‑267‑0030.

The wbf assessment applies to each full or partial hour worked by each paid individual that. • the taxable wage base for unemployment insurance (ui) is $43,800. What is the oregon transit tax?

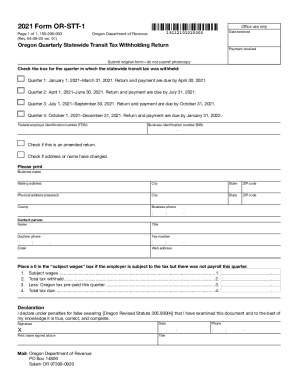

The trimet transit tax rate for 2021 is.007837, an increase from the current.007737. Check the box for the quarter in which the statewide transit tax was withheld: 2021 oregon multnomah county preschool tax [or_mpfa102] 2021 oregon statewide transit tax [orsttr] rate updates:

Taxes that provide operating revenue for trimet are administered and collected by the oregon department of revenue. Check the box for the quarter in which the statewide transit tax was withheld: Tax rates • the workers’ benefit fund (wbf) assessment rate is 0.022.

• lane transit district (ltd) tax rate is 0.0076. Wages of nonresidents who perform services in oregon. (1) wages paid to residents of oregon regardless where they work;

2021 kansas withholding tables cumberland, kentucky local new york state/ yonkers withholding tables; In calendar year 2021, the lane transit district tax will be increasing from the current.0075 to.0076. • statewide transit tax rate is 0.001.

A statewide transit tax is being implemented for the state of oregon. Wages of oregon residents (regardless of where the work is performed). Oregon employers must withhold 0.1% (0.001) from each employee’s gross pay.

Mailing of this booklet and forms Employers may be relieved of the duty to pay transit tax where it can be shown to the satisfaction of the department that subject wages paid to each individual employee will be $300 or less in a calendar year. Exempt payroll the following are exempt from transit payroll taxes:

There is no maximum wage base. Oregon statewide transit tax 2021. The tkt payroll 1st miscellaneous deduction.

Return and payment are due by april 30, 2021. What is the wbf assessment rate for 2021? Ohio withholding tables system updates:

Rate form or stt 1, oregon quarterly statewide transit tax withholding return, 150 206 003 as 5 stars rate form or stt 1, oregon quarterly statewide transit tax withholding return, 150 206 003 as 4 stars rate form or stt 1, oregon quarterly statewide transit tax withholding return, 150 206 003 as 3 stars rate form or stt 1, oregon quarterly statewide transit tax withholding return, 150 206 003 as 2. (2) wages paid to nonresidents of oregon while they are working in oregon;

Ezpaycheck How To Handle Oregon Statewide Transit Tax

2

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Transit Tax - Fill Out And Sign Printable Pdf Template Signnow

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

What Is The Oregon Transit Tax How To File More

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

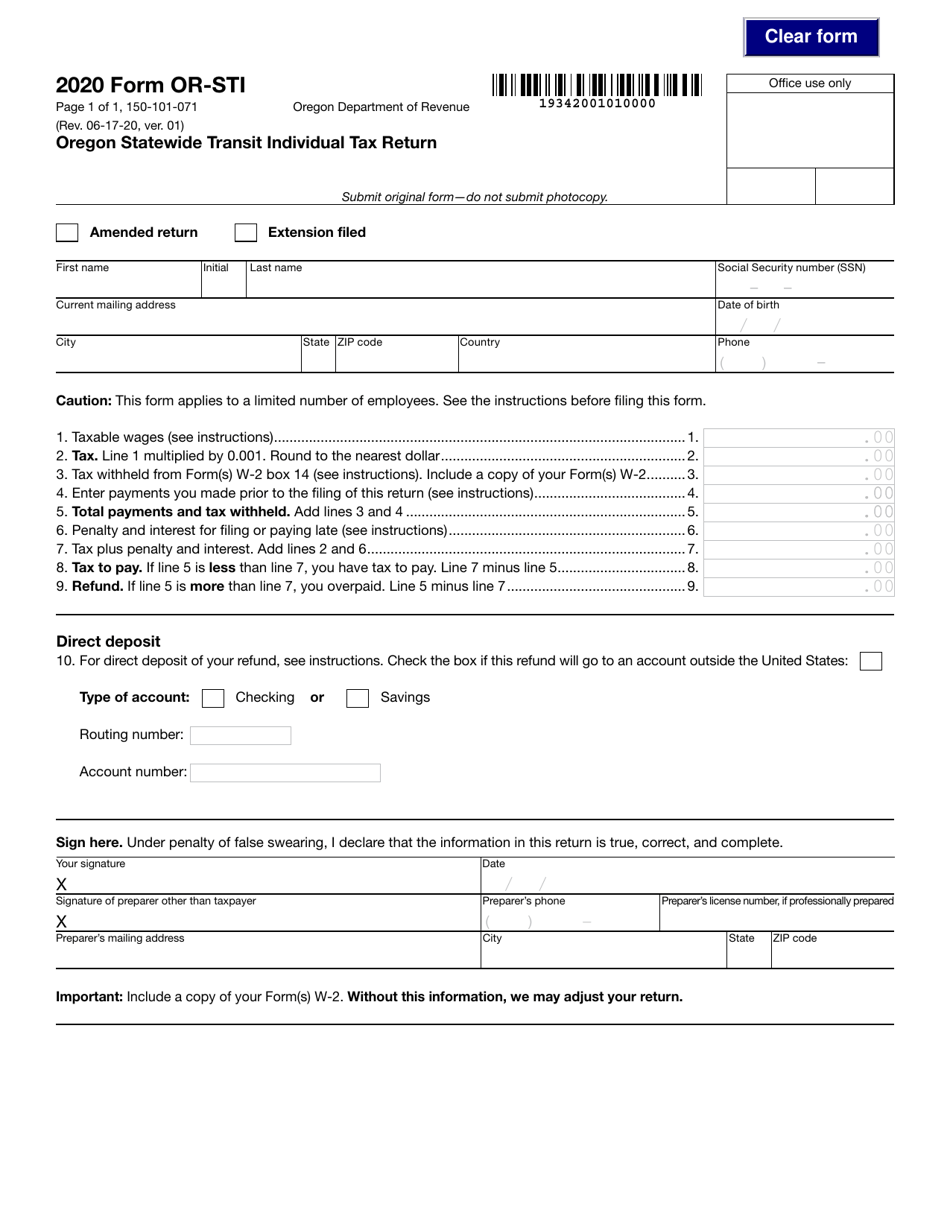

Form Or-sti 150-101-071 Download Fillable Pdf Or Fill Online Oregon Statewide Transit Individual Tax Return - 2020 Oregon Templateroller

Oregon Statewide Transit Tax

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

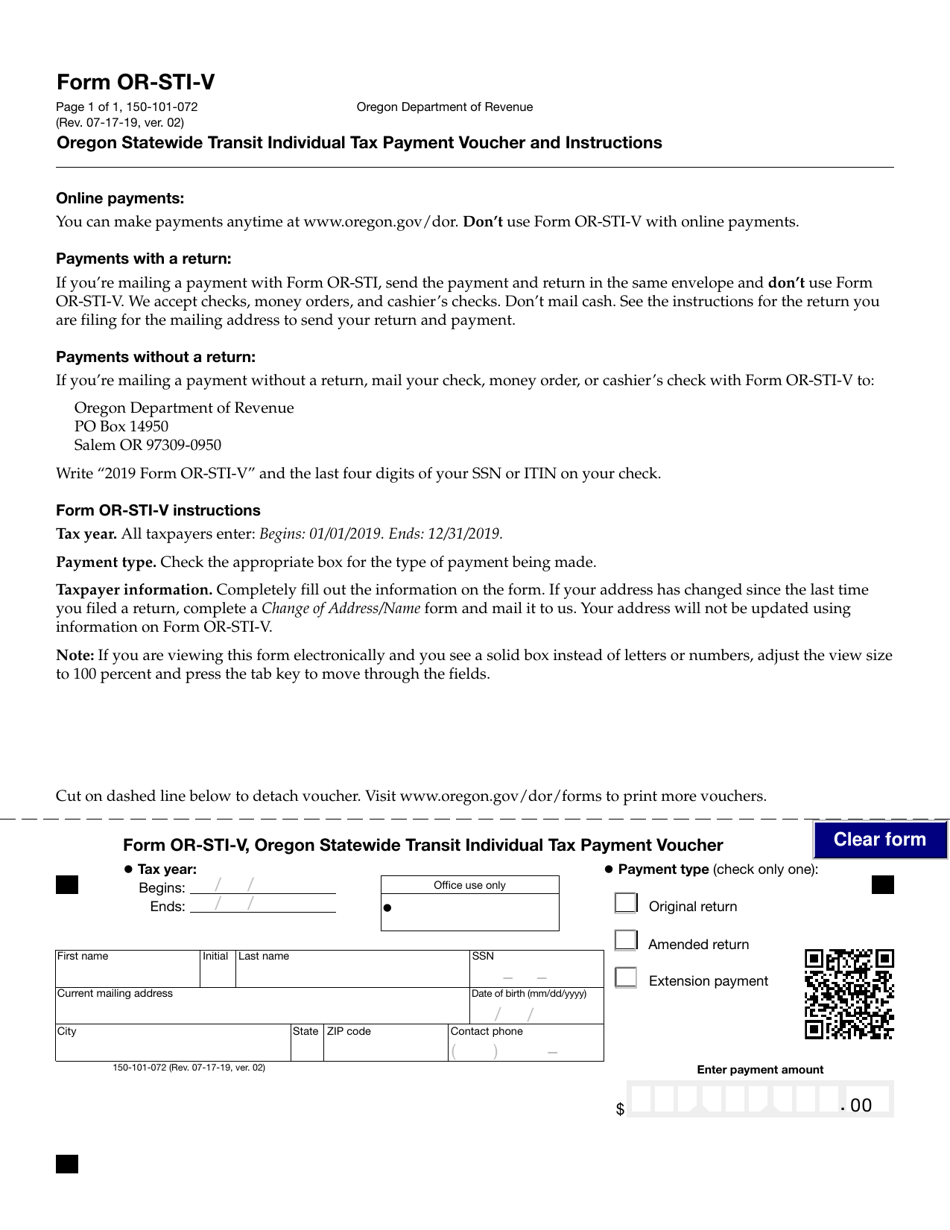

Form Or-sti-v 150-101-072 Download Fillable Pdf Or Fill Online Oregon Statewide Transit Individual Tax Payment Voucher Oregon Templateroller

Oregon Statewide Transit Tax

2

Payroll Systems Attn Oregon - Statewide Transit Tax Effective July 1 - Payroll Systems