Likelihood Of Capital Gains Tax Increase In 2021

That’s a pretty strong incentive for. In some cases you must add the 3.8% obamacare tax, but at.

Rethinking How We Score Capital Gains Tax Reform Bfi

See more tax changes and key amounts for the 2021 tax year.

Likelihood of capital gains tax increase in 2021. Under this proposed tax, combined federal and state taxes on capital gains would average 48 percent (itself a 66 percent increase over current law), exceed 50 percent in thirteen states and the district of columbia, and reach 58.2 percent in new york city.[12] the combined average federal and state capital gains would surpass denmark, chile, and france to become the highest capital gains tax. To address wealth inequality and to improve functioning of our tax system, tax rates on capital gains income should be increased. One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law.

Joe biden is set to propose a capital gains tax hike for the wealthiest, reports said. Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the nervousness that the chancellor would bring cgt more in line with income tax but again this did not materialise. In theory, it would be straightforward to ‘simplify’ many iht rules with.

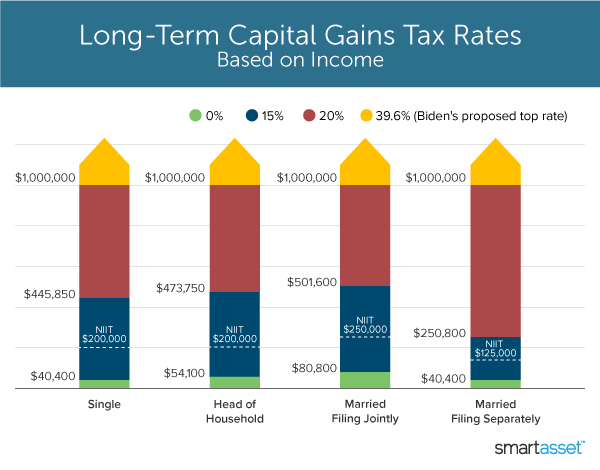

House democrats propose raising capital gains tax to 28.8% published mon, sep 13 2021 3:33 pm edt updated mon, sep 13 2021 4:06 pm edt greg iacurci @gregiacurci Will the capital gains tax rates increase in 2021? Up to now, the tax rate on capital gain has been zero, 15% or 20%, depending on your income.

The current tax preference for capital gains costs upwards of $15 billion annually. Business owners planning to sell or exit their business should seek professional advice sooner rather than later to mitigate the risk of a significantly increased tax liability, a leading corporate finance expert has warned. There will be a budget in the spring of 2021.

Posted on january 7, 2021 by michael smart. It’s time to increase taxes on capital gains. In terms of timing, there is a clear consensus that now is not the time to increase tax rates.

Capital gains tax is likely to rise to near 28%. Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is a steep hike even for the wealthiest among us. History is a good indicator of the impact of a capital gains increase on m&a in the insurance agent and broker market.

Perhaps the most newsworthy item in the treasury department greenbook was the biden administration's proposal to increase taxes on capital gains on a retroactive basis. The house ways and means committee released their tax proposal on september 13, 2021.a summary can be found here and the full text here.the proposal would increase the maximum stated capital gain rate from 20% to 25%. The effective date for this increase would be september 13, 2021.

It is possible the rates may increase from 6 april 2021 but there is no realistic likelihood of any increase for the remainder of this tax year. Bmo also outperforms the tsx, thus far, 2021 (+36.6% versus +19.35). The annual cgt exemption is currently £12,300.

The chart below illustrates how the change in capital gains tax rates affects the sellers' net proceeds. To fund the bbb, original drafts included widespread tax increases on individuals and corporations, including an increase in the capital gains rate. President joe biden is expected to propose raising the top federal capital gains tax to 39.6%, from the current 20%, for millionaires.

To evaluate, we looked back to 2012, when capital gains rates increased from 15% to 20% on jan. For months now there has been speculation that capital gains tax rates will go up in the forthcoming budget. Capital gains tax reform likely to happen within 12 months, warns corporate finance expert.

Once again, no change to cgt rates was announced which actually came as no surprise. More from your money, your future:

The Tax Impact Of The Long-term Capital Gains Bump Zone

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

What You Need To Know About Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The Tax Impact Of The Long-term Capital Gains Bump Zone

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Tax Hikes Lessons From Past Tax Hikes Fidelity

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

What You Need To Know About Capital Gains Tax

Capital Gain Pengertian Jenis Dan Perbedaannya Dengan Dividen

Whats In Bidens Capital Gains Tax Plan - Smartasset

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Tax 101

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Democrats Are Among The Doubters Of Bidens Plan To Tax The Rich Financial Times