Nj Property Tax Relief 2018

Property tax relief forms property tax relief forms homestead benefit program: The most common programs are as follows:

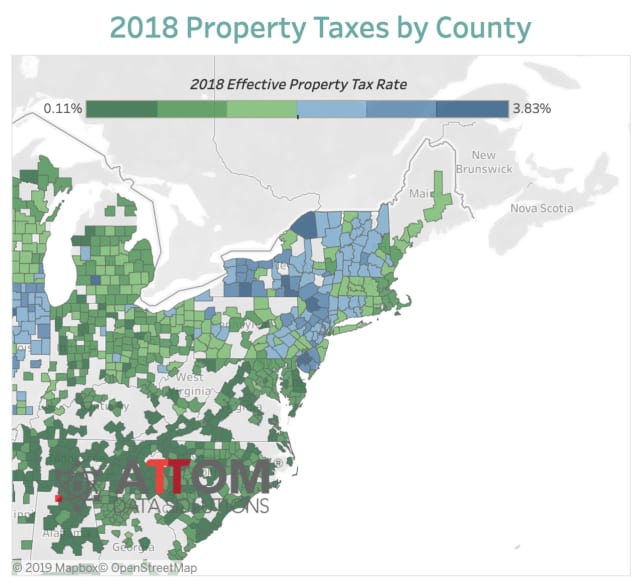

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

If a reimbursement has been issued, the system will tell you the amount of the reimbursement and the date it was issued.

Nj property tax relief 2018. Your 2018 homestead benefit is based on your: Homeowners and tenants who pay property taxes on a primary residence (main home) in new jersey, either directly or through rent, may qualify for either a deduction or a refundable credit when filing an income tax return. Dent income tax return (form nj‑1040 or return that was filed using nj webfile or approved vendor software).

The property tax deduction reduces your taxable income. The state’s other significant dedicated revenue, the ppgrt, is up 70.7 percent through the end of may, $474.0 million above the same point last year, due to a statutory tax rate increase. By contrast, between 2018 and 2019, the average homeowner's tax bill rose from $8,767 to $8,953, an increase of 2.12 percent.

2018 new jersey gross income; In fiscal year 2022, over 760,000 new jersey families will receive an up to $500 tax rebate due to the millionaires tax enacted by the governor and the legislature last. Under the income tax rebate, which was first announced last fall, married couples in new jersey with income below $150,000 and at least one dependent child, and single parents with less than.

The 2018 property taxes due on your home must have been paid by june 1, 2019, and the 2019 property taxes must be paid by june 1, 2020. $250 senior citizens and disabled persons property tax deduction. The homestead benefit program provides property tax relief to eligible homeowners.

Property tax reimbursement (senior freeze) program other property tax. Nj income tax property tax deduction/credit for homeowners and tenants. All property tax relief program information provided here is based on current law and is subject to change.

State of new jersey property tax relief information. The exact property tax levied depends on the county in new jersey the property is located in. If you are age 65 or older, or disabled, and have been a new jersey resident for at least one year, you may be eligible for an annual $250 property tax deduction.

You leased a site in a mobile home park where you placed a manufactured or mobile home that you owned since december 31, 2015, or earlier (and still lived in that home/leased the site. Online tax & sewer payments. The state of new jersey offers tax relief in various forms to certain property owners.

Age/disability status (whether you were 65 or older and/or blind or disabled on december 31, 2018); Delinquent taxes & sewer charges. Applications for the homeowner benefit are not available on this site for printing.

Qualified homeowners and tenants are eligible for a deduction for property taxes they paid for the calendar year on their new jersey principal residence. You also may qualify if you are a. You can deduct your property taxes paid or.

On january 1, 2017, the tax rate decreased from 7% to 6.875%. For most homeowners, the benefit is distributed to your municipality in the form of a credit, which reduces your property taxes. Check the status of your new jersey senior freeze (property tax reimbursement).

On january 1, 2018, and after, the tax rate will decrease to 6.625%. The new jersey homestead benefit program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on behalf of eligible homeowners to reduce their tax liability. Senior freeze (property tax reimbursement) inquiry.

The tax data tables also show that tax ratables rose 2 percent. The reduced tax relief is sure to be a bitter pill for homeowners to swallow this year, since it comes after yet another increase in new jersey property. The senior freeze (property tax reimbursement) program reimburses senior citizens and disabled persons for property tax increases.

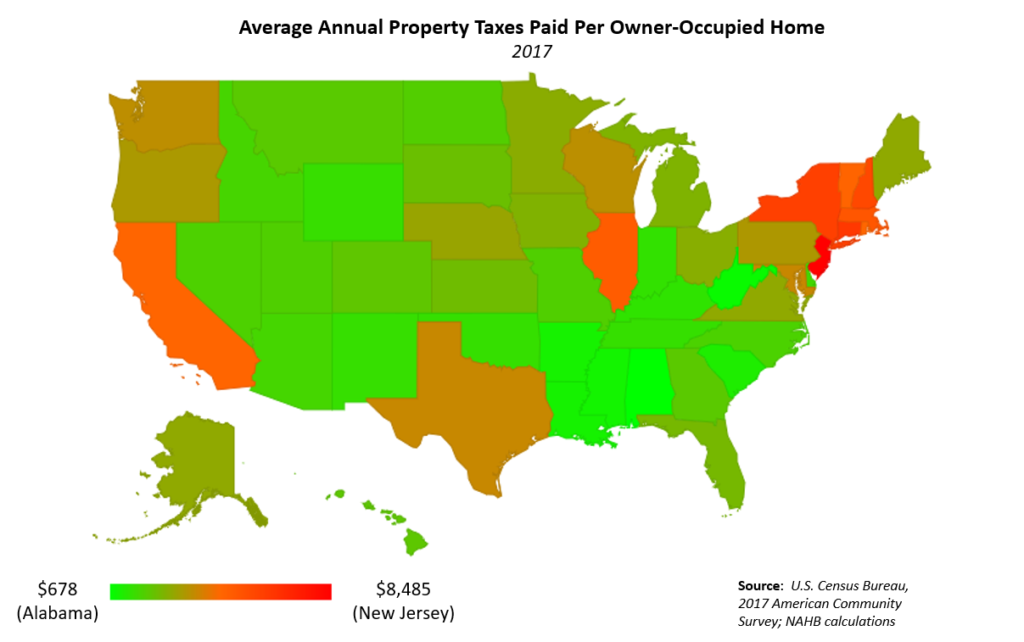

Mobile home owners only : The new law, enacted in july 2018, increases the maximum property tax deduction from $10,000 to $15,000. Hunterdon county collects the highest property tax in new jersey, levying an average of $8,523.00 (1.91% of median home value) yearly in property taxes, while cumberland county has the lowest property tax in the state, collecting an average tax of $3,744.00 (2.13% of median home value) per year.

Florida Property Tax Hr Block

Look Uppay Property Taxes

New York Property Tax Calculator 2020 - Empire Center For Public Policy

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Jefferson County Ky Property Tax Calculator - Smartasset

Berkeley Residents Urged To Apply For Nj Property Tax Rebates In 2021 Best Home Loans Credit Card Debt Settlement Project Management Professional

Nj Senior Freeze Property Tax Reimbursement Access Wealth

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real Estate Tips Real Estate License Real Estate Agent

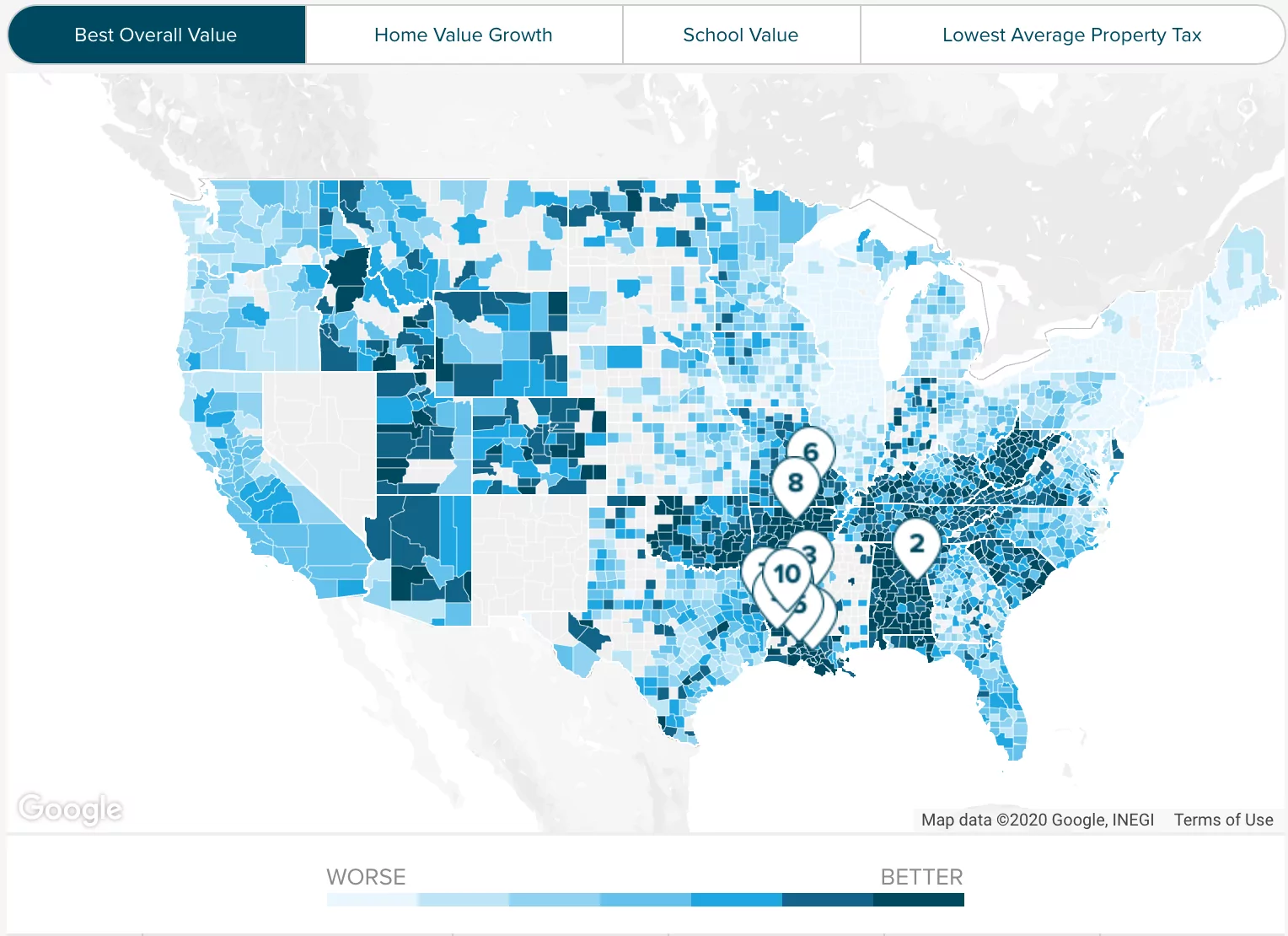

Property Taxes By State 2017 Eye On Housing

Property Tax Prorations - Case Escrow

Real Property Tax Howard County

The Top Ten Events In Somerset County Nj This Weekend March 30 - April 1 2018 - Joe Peters Somerset County Somerset County

Pdf Land And Property Tax A Policy Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Deducting Property Taxes Hr Block

Nj Property Tax Relief Program Updates Access Wealth

Disabled Veterans Property Tax Exemptions By State

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice