Income Tax Rate Indonesia

Sourced is taxed at standard income tax rates. Generally, a flat rate of 22% applies (becoming 20% in 2022).

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

6 indonesian pocket tax book 2021 pwc indonesia corporate income tax tangible assets categories useful life depreciation rate straight line method declining balance method category 3 16 years 6.25% 12.5% category 4 20 years 5% 10% ii.

Income tax rate indonesia. Taxable income (in indonesian rp) tax rate (%) on the first 50 million. If the total amount of tax paid in advance through the year (articles 22, 23, and 25 income taxes) and the tax paid abroad (article 24 income tax) is less than the total cit due, the taxpayer has to. The corporate tax rate in indonesia stands at 22 percent.

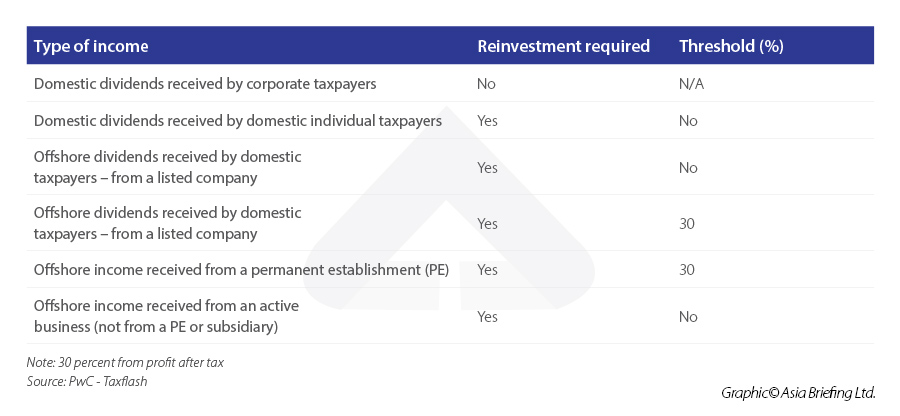

Interest on indonesian bonds is subject to final tax at 15%, whilst a final withholding tax of 10% is imposed on dividends received from an indonesian company. Level of income tax rate rp. Concessions are, however, available where a dta is in force.

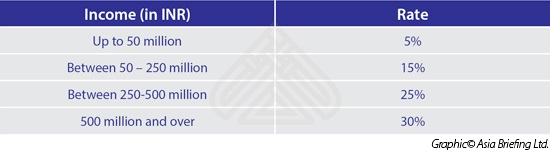

In indonesia, everyone’s income is subject to a basic tax allowance. The current rates range from 5 percent up to a maximum of 30 percent for income earned over 500 million indonesian rupiah (idr). Listed companies that meet certain conditions are eligible for a 5% reduction in the corporate tax rate.

Consolidation of law of the republic of indonesia number 7 of 1983 concerning income tax as lastly amended by law number 36 of 2008 chapter i general provision article 1 income tax shall be imposed on any taxable person in respect of income during a taxable year. For fiscal year 2020/2021, the cit rate is 22%, and for the year 2022 onwards, the cit rate will be 20%. Resident tax payers are subject to progressive tax rates ranging from 5 percent to 30 percent.

In general, a corporate income tax rate of 25 percent applies in indonesia. Personal income tax rate in indonesia averaged 31.56 percent from 2004 until 2019, reaching an all time high of 35 percent in 2005 and a record low of 30 percent in 2009. Net taxable income for residents is taxed at graduated rates.

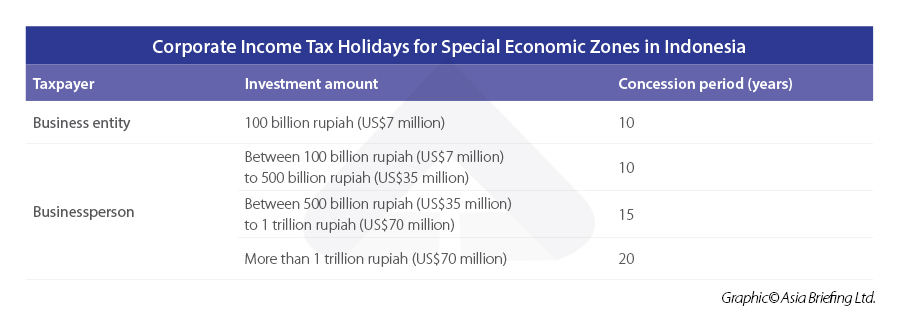

However, there are several exemptions: Chapter ii taxable person article 2 (1) tax subject consist of: Companies listed on the indonesia stock exchange (idx) that offer at least 40 percent of their total share capital to the public obtain a 5 percent tax cut (hence a tax rate of 20 percent applies for these public companies).

Up to this amount, your taxable income is not subject to tax. The rates applied to taxable income are shown below. Corporate tax rate in indonesia averaged 27.76 percent from 1997 until 2021, reaching an all time high of 39 percent in 2002 and a record low of 22 percent in 2021.

Other types of investment income are assessable at standard income tax rates. Portion of income over rp 500 million: Corporate tax rates in indonesia are levied as follows:

A company with gross turnover of less than idr 50 billion (approximately usd 5.5 million) is eligible for a 50% reduction in the corporate tax rate on the proportion of taxable income which results when idr 4.8 Over 50 million but not exceeding 250 million. If your taxable income is higher than the basic tax allowance, you will have to pay for your income tax.

This regulation also applies to expatriates. • indonesia imposes a range of taxes on individuals and corporate taxpayers. Over 250 million but not exceeding 500 million.

The corporate tax rate is 25%. The rates applied to taxable income are shown below: Corporate income tax rate of indonesian companies the corporate income tax (cit) rate in indonesia is 25%.

Companies are taxed only on income derived in indonesia. The personal income tax rate in indonesia stands at 30 percent. Indonesia is no exception, as it imposes both corporate taxes on companies doing business in indonesia as well as personal income tax for the employees.

It is important to note that the tax payment paid to other countries is granted tax deduction in indonesia. Here we explain the main taxes: Taxable income for the companies shall be assessable income less tax deductible expenses.

The indonesian tax office (direktorat jenderal pajak) requires all resident individuals in indonesia to have their own personal tax numbers, nomor pendaftaran wajib pajak or npwp.

Indonesia Vat Everything You Need To Know About Value-added Tax

Qi0dgiw7f9lsxm

Calculate Employee Income Tax In Indonesia - Blog Gadjian

Taxation Bkpm Japan

Individual Income Tax Indonesian Tax

What Are The Changes In Tax Treatment Under Indonesias Omnibus Law

Taxation System In Indonesia Your Guide To Income Taxation

Calculate Employee Income Tax In Indonesia - Blog Gadjian

Miris Ternyata Tax Ratio Indonesia Terendah Di Asia Pasifik

Indonesias Economy To Return To Growth In 2021 Adb Asian Development Bank

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Calculate Employee Income Tax In Indonesia - Blog Gadjian

Incentives Invest Indonesia

Tax Incentives For Special Economic Zones In Indonesia

Asean-chart-2 Indo - Asean Business News

Hchtfk5gtys0vm

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Personal And Corporate Income Tax Indonesia How To Calculate It

Taxation System In Indonesia Your Guide To Income Taxation