Pa State Inheritance Tax Waiver Form

Complete, edit or print your forms instantly. (a) payment of inheritance tax.

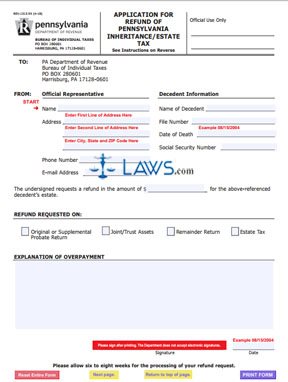

Free Form Application For Inheritance Tax Waiver - Free Legal Forms - Lawscom

As pa property it is subject to the tax so it will have to be paid.

Pa state inheritance tax waiver form. Inheritance tax waiver (this form is for informational purposes only! Enter the information for the decedent associated with the. Inheritance taxes are tied to the state where the decedent resided and.

Statutes and general descriptions pennsylvania inheritance tax is imposed by the inheritance and estate tax act of 1991, which applies to estates of decedents who died on or after oct. You need to clarify the reverse mortgage issue and the state where the property is. Pennsylvania inheritance tax on assets passing to your brothers, sisters, nieces, nephews, friends and others.

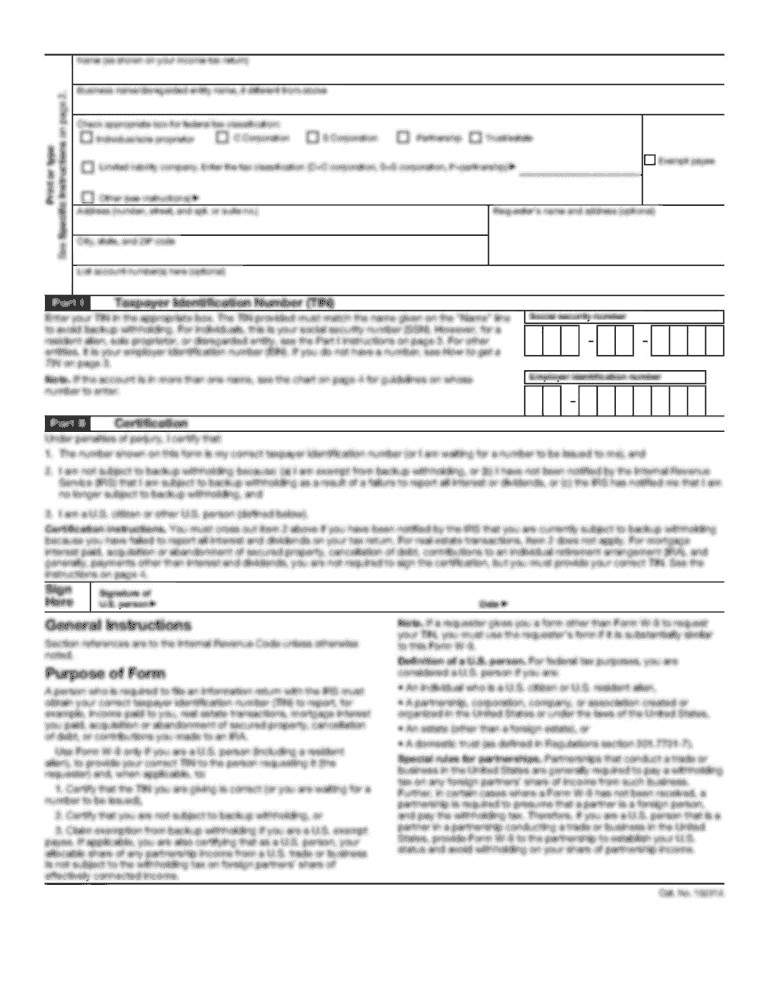

Enter the name or title of the account. Printing and scanning is no longer the best way to manage documents. A tax waiver and certification form must be completed for each owner, executive officer, qualifying individual, branch manager, or mortgage originator.

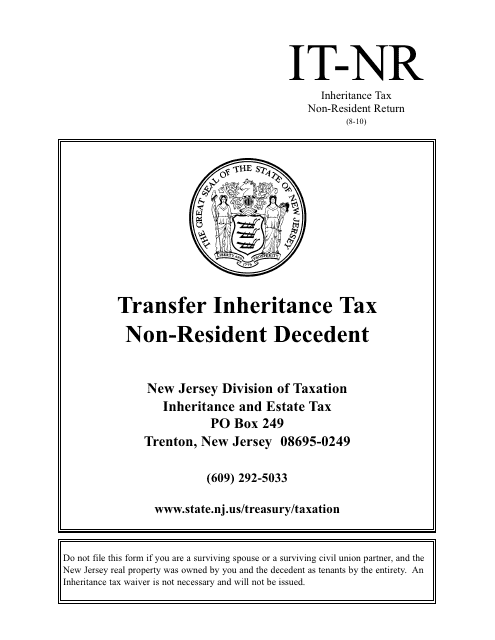

15% for transfers made to any other heirs, not including “charitable organizations. Enter the information of the entity that maintains the. You are referring to l9 form which is for new jersey not pa.

Ad access any form you need. Please consult with your financial advisor/accountant/attorney) no tax is claimed upon the following items of property described as being in your Whether the form is needed depends on the state where the deceased person was a resident.

By submitting this form to the department, owner, executive officer, qualifying individual, branch Ad access any form you need. The personal representative (executor or administrator) appointed by the register of wills or the fiduciary charged with the duty of filing a federal estate tax return (irs form 706).

12% for transfers to siblings. Pennsylvania is one of seven states that collects an inheritance tax based off of the value of a decedent’s estate that is conveyed to a beneficiary. After processing, you will receive a waiver letter granting the institution permission to transfer the asset to the beneficiary(ies).

However, if you are the surviving spouse you or you have a tax clearance from the pit division that shows inheritance taxes have already been paid on. According to us bank, as of february 2015, alabama, indiana, nebraska, new jersey, ohio, pennsylvania, puerto rico, rhode island. One waiver request must be submitted per asset.

Of revenue, bureau of individual taxes. Complete, edit or print your forms instantly. 0% for all transfers to a “surviving spouse” or to a “parent from a child aged 21 or younger”.

An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person. This form must be completed as instructed below. Download or email fillable forms, try for free now!

Inheritance tax is a tax on the right of succession or privilege of receiving property at a death, and it is imposed upon the transfer of taxable property. You do not need to draft another document. Without a waiver and subject to limitations established by regulation, no person or institution in possession of the assets.

Enter the information for the asset. How does the inheritance tax work in pennsylvania? Download or email fillable forms, try for free now!

Exact forms & protocols vary from state to state and. There is no inheritance tax to children in nj so that is why you would be able to use the waiver but that's only if the property is in nj. The net value subject to tax is determined by subtracting from the value of the gross estate the amount of approved deductions.

All legal sized documents must be reduced to 8 1/2 x 11 paper. — no corporation, financial institution,. Therefore, the value of the assets you receive and your relationship to the decedent will determine the percentage of your tax liability.

To effectuate the waiver you must complete the pa form rev 516; Once the waiver request is processed you will receive a letter form the. The tax rates for pennsylvania’s inheritance tax are:

5% for transfers to “direct descendants” and “lineal heirs”. Handy tips for filling out pa inheritance tax waiver online.

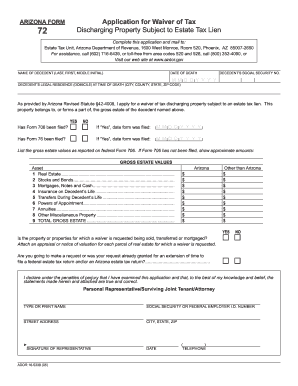

Arizona Inheritance Tax Waiver Form - Fill Out And Sign Printable Pdf Template Signnow

Form Rev-516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Revenuepagov

Pa Inheritance Tax Waiver - Fill Online Printable Fillable Blank Pdffiller

Fillable Online Inheritance Tax Forms - Pa Department Of Revenue - Pagov Fax Email Print - Pdffiller

Rev-516 - Request For Waiver Or Notice Of Transfer Free Download

17 States With Estate Taxes Or Inheritance Taxes

Form It-nr Download Fillable Pdf Or Fill Online Transfer Inheritance Tax Non-resident Decedent New Jersey Templateroller

Pennsylvania Inheritance Tax - 39 Free Templates In Pdf Word Excel Download

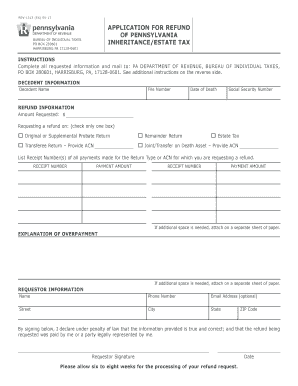

Free Form Rev-1313 Application For Refund Of Pennsylvania Inheritance Estate Tax - Free Legal Forms - Lawscom

Form Rev-516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

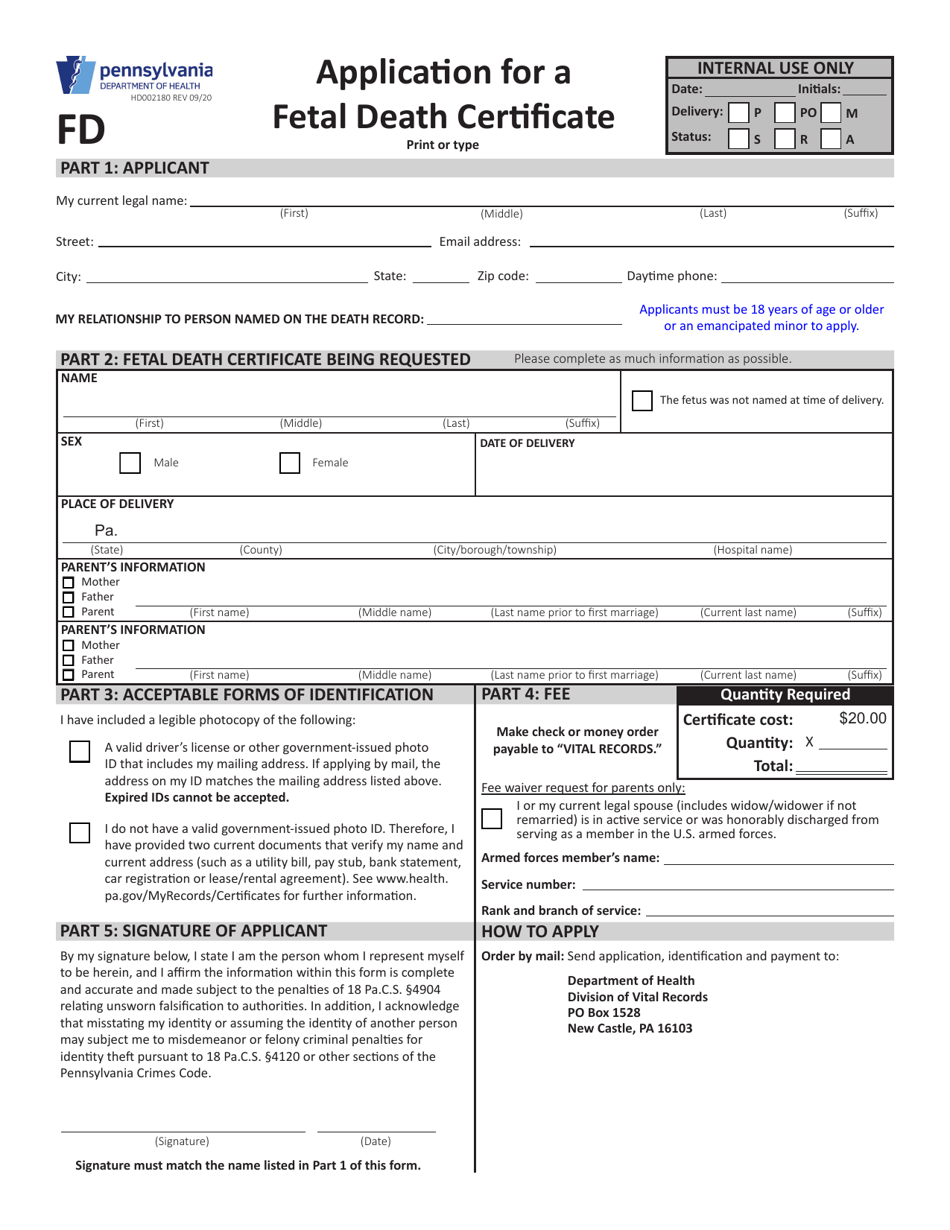

Form Hd002180 Download Fillable Pdf Or Fill Online Application For A Fetal Death Certificate Pennsylvania Templateroller

61 Pa Code Chapter 31 Imposition

Rev-1197 - Schedule Au - Agricultural Use Exemptions Free Download

Revenuepagov

Pa Inheritance Tax Waiver - Fill Online Printable Fillable Blank Pdffiller

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Pennsylvania Inheritance Tax - 39 Free Templates In Pdf Word Excel Download

Phillyviporg