Maryland Earned Income Tax Credit 2020

For example, the credit for those filing as single/head of household is calculated differently than the credit for those filing jointly. An expansion of maryland’s earned income tax credit passed quietly into law when gov.

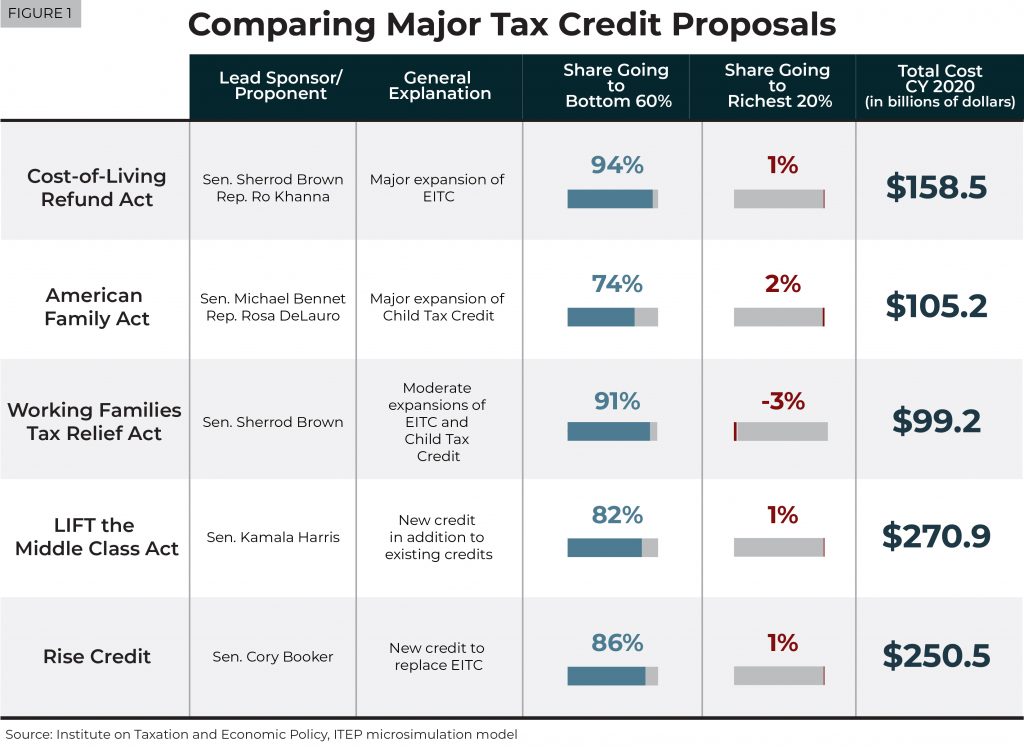

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Phaseout begins single, head of household, widow(er) $8,790:

Maryland earned income tax credit 2020. The maryland earned income tax credit (eitc) will either reduce or eliminate the amount of the state and local income tax that you owe. Earned income tax credit (eitc) relief. Check how to qualify for the child tax relief program with our guide.

(r) allowed the bill to take effect without his signature. 2020 earned income tax credit information for california, illinois, louisiana, maryland, oregon, texas, and virginia. If you qualify for the federal earned income tax credit also qualify for the maryland earned income tax credit.

The credit is equal to 50% of the federal tax credit. Earned income tax credit the earned income tax credit (eitc) is a benefit for working people with low to moderate income. Phaseout ends single, head of household, widow(er) $15,820:

2020 maryland earned income tax credit (eitc) maryland’s eitc is a credit for certain taxpayers who have income and have worked. One of the biggest changes is the addition of a new 25% tax credit for donations to permanent endowment funds to maryland historically black colleges and universities. Finally, for tax years 2020, 2021, and 2022, the law increases the refundable earned income tax credit to 45 percent for families and 100 percent for individuals without qualifying children.

Www.cashmd.org earned income tax credit for the 2020 tax year: 2020 states with earned income tax requirements state requirement california assembly bill 650 requires that an employer shall notify all employees that they may be eligible for the federal and the california eitc within one week before or after, or at the same time, that the employer provides an annual wage summary, See instruction 26 in the maryland tax booklet for more information on claiming the earned income credit.

Check how to qualify for the child tax relief program with our guide. The expanded tax credit will arrive as soon as they file their 2020 tax returns, and they will be eligible to receive that higher amount for the next three years. The bill’s purpose is to expand the numbers of taxpayers to whom the earned income credit (eic) is available and to provide for a new maryland child tax credit.

If you qualify for the federal earned income tax credit and claim it on your federal return, you may be entitled to a maryland earned income tax credit on the state return equal to 50% of the federal tax credit. Maryland residents can look forward to more opportunities for tax credits and a lower interest rate on taxes that are due by april 15, 2020 (for the 2019 tax year) but paid late. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

The relief act also enhances the earned income tax credit for these same 400,000 marylanders by an estimated $478 million over the next three tax years. More support for unemployed marylanders the relief act will repeal all state and local income taxes on unemployment benefits for tax years 2020 and 2021, helping people get more refunds during tax filing season. Ad review the guidelines and steps to apply for the child tax relief program with our guide.

The tax change allows parents to shift income from 2019 into 2020 in order to qualify for a higher (and refundable) tax credit. This temporary relief is provided through the taxpayer certainty and disaster tax relief act of 2020. Senate bill 218 extends the tax credit to people who pay taxes using individual taxpayer identification numbers (itins) for the 2020, 2021 and 2022 tax years.

Earned income tax credit for tax year 2020 no children one child two children three or more children; Detailed eitc guidance for tax year 2020, including annual income thresholds can be found here. Does maryland offer a state earned income tax credit?

2020 maryland earned income tax credit (eitc) maryland’s eitc is a credit for certain taxpayers who have income and have worked. The eic has no effect on certain welfare benefits and in most cases the eic tax payments will not be used. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

If you earn less than $57,000 per year, you can get free help preparing your maryland income tax return through the cash campaign. Ad review the guidelines and steps to apply for the child tax relief program with our guide. Expansion of the earned income credit (sb218) was enacted under article ii, section 17(b) of the maryland constitution.

For the maryland eitc, file tax form 502. To figure the credit, see publication 596, earned income credit. Thestate eitcreducesthe amount of maryland tax you owe.

If your earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your eitc for 2020. Thestate eitcreducesthe amount of maryland tax you owe. However, the amount of the credit is figured based on family size, income, age, and how you file.

Realistically, the change may be too complex for the intended beneficiaries to apply on their own, but competent tax preparation will enable them to realize a greater credit in 2020, and will be worth up to $1,400 for every qualifying child. 496, laws 2021, effective february 15, 2021. The comptroller began accepting tax year 2020 returns for processing prior to the enactment of sb218.

O earned less than $50,954 ($56,844 married filing jointly) with three or more qualifying children earned less. The maximum credit for the 2020 tax year is $6,660, and the maximum income to qualify for any credit is $56,844.

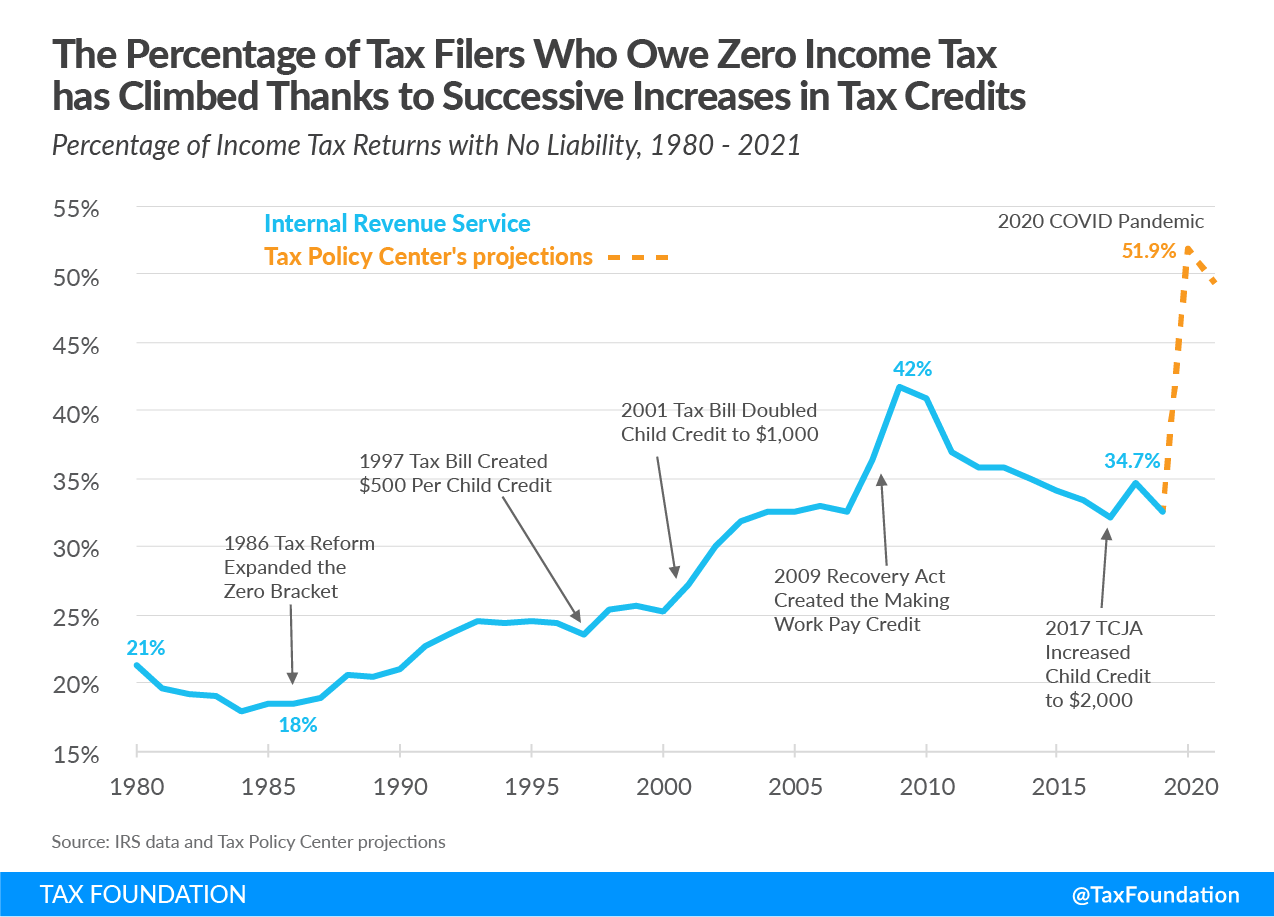

Increasing Share Of Us Households Paying No Income Tax

Pdf The Effects Of Income On Health New Evidence From The Earned Income Tax Credit

Earned Income Tax Credits Employee Notification Requirements

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Proposals For Refundable Tax Credits Are Light Years From Tax Policies Enacted In Recent Years Itep

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

2

2

What Are Marriage Penalties And Bonuses Tax Policy Center

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

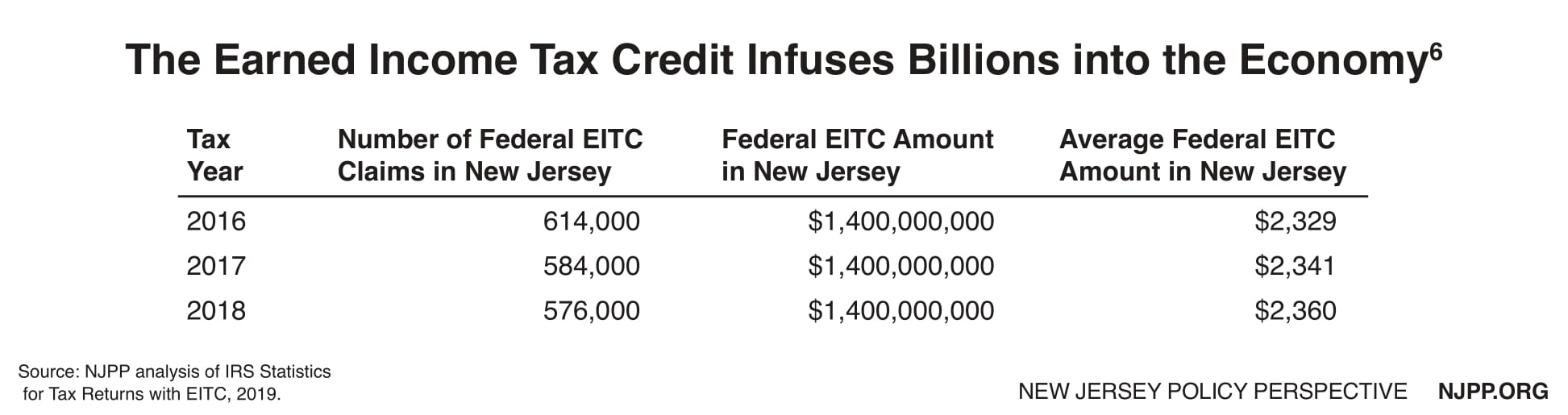

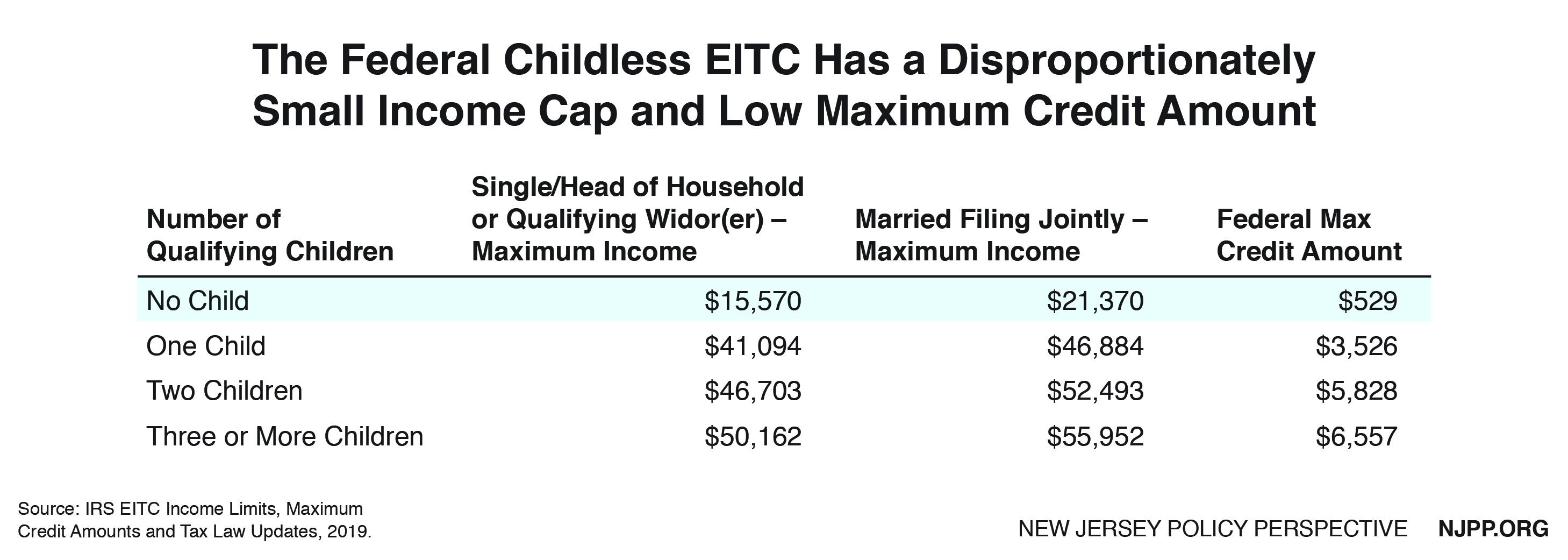

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers - New Jersey Policy Perspective

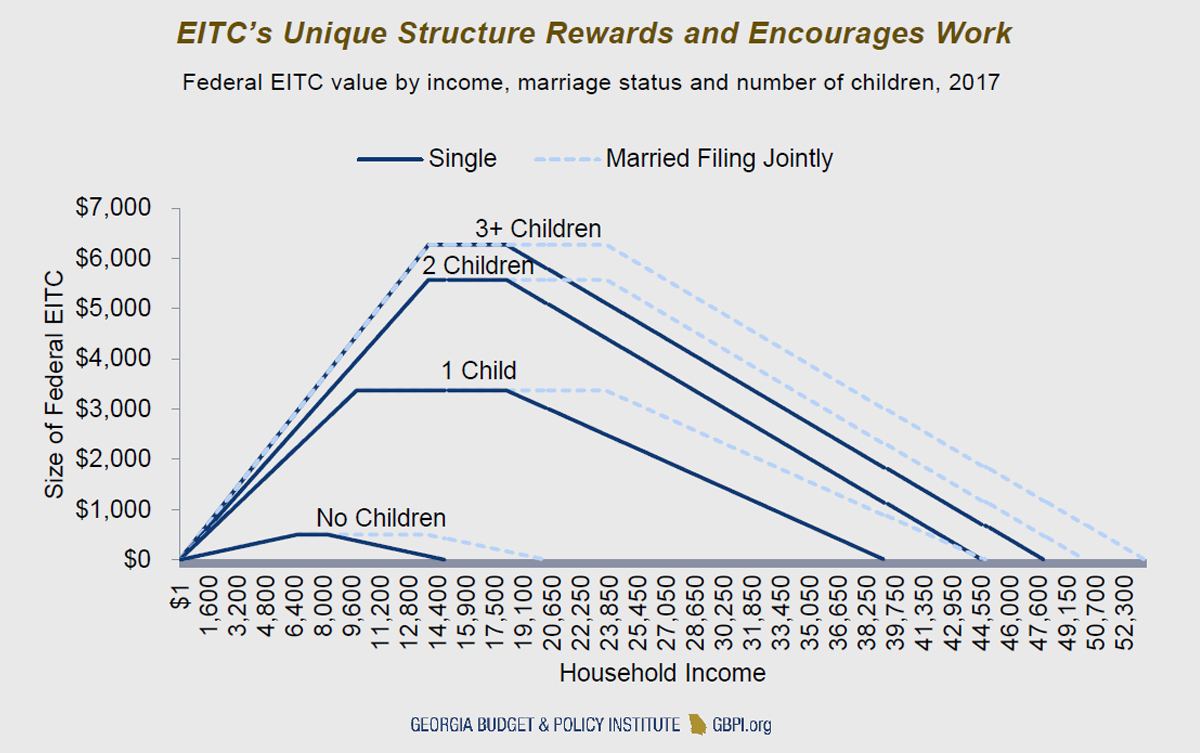

The Earned Income Tax Credit And Young Adult Workers - Georgia Budget And Policy Institute

The Earned Income Tax Credit And Young Adult Workers - Georgia Budget And Policy Institute

2

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers - New Jersey Policy Perspective

See The Eic Earned Income Credit Table Income Tax Return Earnings Tax Refund

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Stimulus Checks California And Maryland Approve Plans To Send Direct Payments To Eligible Residents In 2021 Checks University Of Los Angeles How To Plan