Nebraska Inheritance Tax Calculator

The rate depends on your relationship to your benefactor. Free estate tax calculator to estimate federal estate tax in the u.s.

Refundable Income Tax Credit For Property Taxes Paid To Schools Nebraska Farm Bureau

To begin with, you ought to know that florida does not have an estate tax at the state level.

Nebraska inheritance tax calculator. In 2012, nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. The nebraska inheritance tax is a lien on the property being transferred. The fair market value is the present value as determined under the provisions of the internal revenue code of 1986, as amended, and.

001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise having characteristics of annuities, life estates, terms for years, remainders, or reversions reversionary interests. Nebraska is one of a handful of states that collects an inheritance tax. There’s additionally a federal gift tax that’s unified with the estate tax.

Guide to nebraska inheritance tax. Nebraska inheritance and estate taxes edward j. The tax is then going to be calculated on each share.

Nebraska does have an inheritance tax. The rate depends on your relationship to your benefactor. I’ve got more good news for you.

Nebraska does not have a gift tax. Nebraska is one of a handful of states that collects an inheritance tax. The nebraska tax calculator is updated for the 2021/22 tax year.

In addition, property that is. Beneficiaries are responsible for paying the inheritance tax on the assets they inherit. Learn more in sarah curry’s new report, death and taxes:

The federal gift tax allows a $15,000 exemption amount per year and per person. The nebraska income tax calculator is designed to provide a salary example with salary deductions made in nebraska. Nebraska has the highest inheritance tax.

Nebraska’s inheritance tax applies to assets transferred from a beneficiary through a will or through intestacy laws. Nebraska income tax brackets range from 2.46% to 6.84%.nebraska uses a progressive tax rate system, meaning that higher levels of income are taxed at higher rates. If you leave money to your spouse.

Already, 44 states get by without an inheritance tax. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. Nebraska income tax brackets range from 2.46% to 6.84%.nebraska uses a progressive tax rate system, meaning that higher levels of income are taxed at higher rates.

However, if the exemption amount is lower the executor will calculate the tax due based on the difference applied at a tax rate of approximately 40%. The inheritance tax is levied on money already passed from an estate to a person’s heirs. Life insurance passed through the estate is taxed under nebraska’s inheritance tax rules.

Nebraska inheritance tax is computed on the fair Today, nebraska’s income tax rates range from 2.46% to 6.84%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. And, since money subject to inheritance tax may have already been earned and taxed previously, applying a tax to the mere transfer of money can be a form of double taxation.

Nebraska inheritance taxes are due 12 months after the decedent's death. Thus, a practitioner is well advised to note that insurance proceeds payable to a specific beneficiary or living trust will not be subject to tax. The best way to find more information about inheritance taxes in your state is to contact the state tax agency.

Whether they will have to pay the tax, and how much they will have to pay, depends on how closely they were related to you—the. The tax is a state of nebraska inheritance tax but the county receives the money. Beneficiaries must pay the tax if the decedent lived or owned property in nebraska.

The nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. The tax is paid to the county of the deceased person’s residence or, in the case of real estate, to the county in which the real estate is located. The ne tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in nes.

For any amount over $12,500 but not over $25,000, then. Nebraska inheritance and gift tax. Like most estate taxes, inheritance taxes are progressive in all states that use them.

However, immediate relatives are only taxed at a 1% rate. If real estate is owned in more than one Worksheet february 13, 2021 05:04.

The inheritance tax is due and payable within 12 months of the decedent’s date of death, and a penalty is assessed for failure to file timely the appropriate inheritance. Nebraska gift tax & inheritance tax. An inheritance tax return is due within one year of the person’s death, and the state doesn’t offer.

Nebraska is one of a handful of states that collects an inheritance tax. The exemption amount for immediate relatives is $40,000 but drops to $10,000 for extended relatives who pay a 13% tax. The nebraska inheritance tax applies to persons who die while residents of the state or, regardless of state of residence, who die owning real property located in nebraska.

The unique feature about nebraska’s inheritance tax is that it was and still is the only state in the nation to. The rate depends on your relationship to your benefactor. Ad an inheritance tax expert will answer you now!

Ad an inheritance tax expert will answer you now! Late payments would have interest accrued at 14% annually, with additional penalties of 5% per month up to 25% of the tax due. Nebraska can do the same.

If you are a nebraska resident, or if you own real estate or other tangible property in nebraska, the people who inherit your property might have to pay a tax on the amount that they inherit. In iowa, siblings will pay a 5% tax on any amount over $0 but not over $12,500. Nebraska’s inheritance tax was adopted in 1901, before the state had a sales or income tax, and has remained relatively the same for the last 120 years.

2

Nebraska Income Tax Calculator - Smartasset

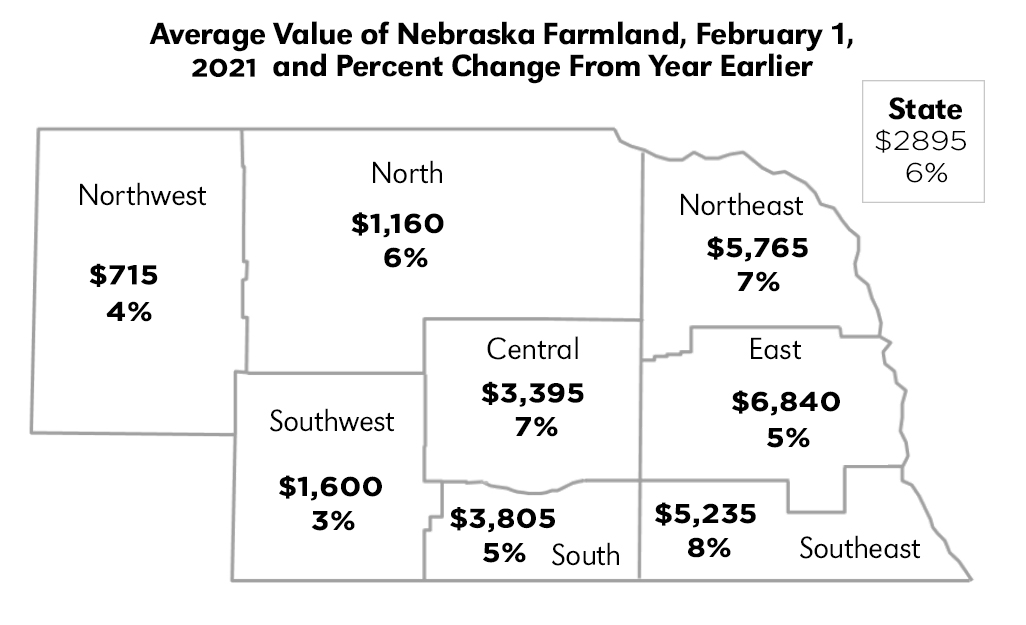

Nebraska Farm Real Estate Report Center For Agricultural Profitability

Most Tax Friendly States For Retirees Ranked Goodlife

2

Nebraska Income Tax Calculator - Smartasset

Nebraska Property Tax Calculator - Smartasset

Democrats Are Among The Doubters Of Bidens Plan To Tax The Rich Financial Times

Pin On Finance

2020 Nebraska Property Tax Issues Agricultural Economics

Prepare And File A Nebraska Income Tax Amendment Form 1040xn

Calculating Inheritance Tax - Lawscom

Nebraskas High Property Taxes Put A Damper On Land Sales Thefencepostcom

How High Are Cell Phone Taxes In Your State Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Nebraska Income Tax Calculator - Smartasset

Nebraska Real Estate Transfer Taxes An In-depth Guide For 2021

Property Taxes On Owner-occupied Housing By State Tax Foundation Infographic Map Map Social Science

Nebraska State Tax Things To Know Credit Karma Tax