Reverse Sales Tax Calculator California

Calculation of the general sales taxes of the city california city, california for 2021. This level of accuracy is important when determining sales tax rates.

Sales Tax Calculator

There are times when you may want to find out the original price of the items you’ve purchased before tax.

Reverse sales tax calculator california. This tool can calculate the transfer/excise taxes for a sale or reverse the calculation to estimate the sales price. The harmonized sales tax, or hst, is a sales tax that is applied to most goods and services in a number of canadian provinces: The formula is fairly simple.

Instead of using the reverse sales tax calculator, you can compute this manually. That entry would be.0775 for the percentage. Québec province is using qst instead of pst.

New brunswick, newfoundland and labrador, nova scotia, ontario, and prince edward island. Since many cities and counties also enact their own sales taxes, however, the actual rate paid throughout much of the state will be even higher than that. Amount with sales tax / (1+ (gst and qst rate combined/100)) or 1.14975 = amount without sales tax.

Reverse sales tax calculator for 93901 salinas, california, united states in 2021 When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. The combined rate used in this calculator (7.75%) is the result of the california state rate (6%), the 91761's county rate (0.25%), and in some case, special rate (1.5%).

Amount without sales tax * gst rate = gst amount. If you know the total sales price, and the sales tax percentage, it will calculate the base price before taxes and the amount of sales tax that was in the. This is very simple gst calculator for québec province.

The second script is the reverse of the first. For example, if you received a $3,000 rebate on your vehicle, and it decreases the total cost to $7,000, you still have to pay sales tax on $10,000, says the sales tax handbook. Fast and easy 2021 sales tax tool for businesses and people from 93901, salinas, united states.

Amount without sales tax * qst rate = qst amount. Reverse sales tax calculator of california city. Transfer/excise tax calculator welcome to the transfer/excise tax calculator.

Please ensure the address information you input is the address you intended. On the right sidebar there is list of calculators for all canadian provinces where hst is introduced. The tax rate given here will reflect the current rate of tax for the address that you enter.

California’s base sales tax is 7.25%, highest in the country. How to calculate sales tax. Enter hst inclusive price on the bottom:

21 rows putting different, the reverse calculator calculates the amount before the sales tax is. Hst value and price without hst will be calculated automatically : The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Type an address above and click search to find the sales and use tax rate for that location. Pre tax price of product = sale price (post tax price) / (1 + tax rate) have you checked california sales calculator? Divide your sales receipts by 1 plus the sales tax percentage.

Welcome to the transfer/excise tax calculator. 5 digit zip code is required. Free online 2021 reverse sales tax calculator for 93901, salinas.

Other provinces in canada do not use the hst and instead use a distinct goods and services tax (gst) and/or provincial sales tax (pst). Op with sales tax = [op × (tax rate in decimal form + 1)] Any input field of this calculator can be used:

This tool can calculate the transfer/excise taxes for a sale or reverse the calculation to estimate the sales price. Amount after taxes sales tax rate (s) 6.5% 7.25% 7.375% 7.5% 7.75% 7.875% 7.975% 8% 8.125% 8.25% 8.375% 8.475% 8.5% 8.725% 8.75% 8.875% 8.975% 9% 9.125% 9.225% 9.25% 9.5% 9.75%. Reverse calculation of the general sales taxes of california state for 2021.

To find the original price of an item, you need this formula: The 91761, ontario, california, general sales tax rate is 7.75%. In case you are interested in doing the calculation manually, here is how to calculate sales tax:

Here is how the total is calculated before sales tax: Enter the sales tax percentage. Reverse sales tax computation formula.

For instance, in palm springs, california, the total sales tax percentage, including state, county and local taxes, is 7 and 3/4 percent. That means that, regardless of where you are in the state, you will pay an additional 7.25% of the purchase price of any taxable good. Reverse sales tax calculator of sacramento calculation of the general sales taxes of the city sacramento, california for 2021 amount after taxes sales tax rate(s) 6.5% 7.25% 7.75% 8% 8.25% 8.5% 8.75% amount of taxes amount before taxes

Divide the sales tax percentage by 100 (or move the decimal point two places to the left) to get the decimal equivalent of the rate.

How To Calculate Sales Tax Backwards From Total

Sacramento County Sales Tax Rates Calculator

Sales Tax Reverse Calculator Internal Revenue Code Simplified

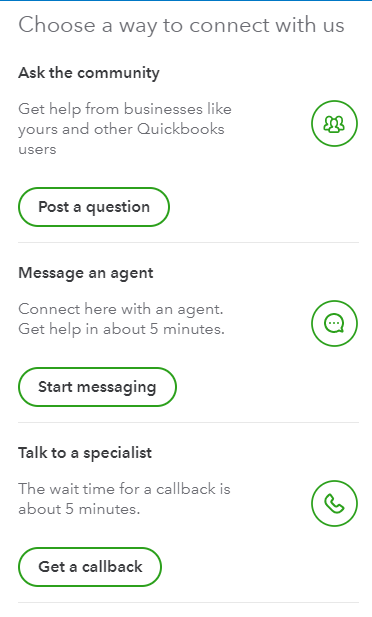

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

California Sales Tax Calculator Reverse Sales Dremployee

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Jyoti -

How To Calculate Sales Tax Backwards From Total

How To Calculate Sales Tax In Excel

How To Pay Sales Tax For Small Business 6-step Guide Chart

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

Sales Tax Calculator

Property Tax Calculator

Kentucky Sales Tax Calculator Reverse Sales Dremployee

California Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator De-calculator - Accounting Portal

Ontario Sales Tax Hst Calculator 2021 Wowaca

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Us Sales Tax Calculator Reverse Sales Dremployee